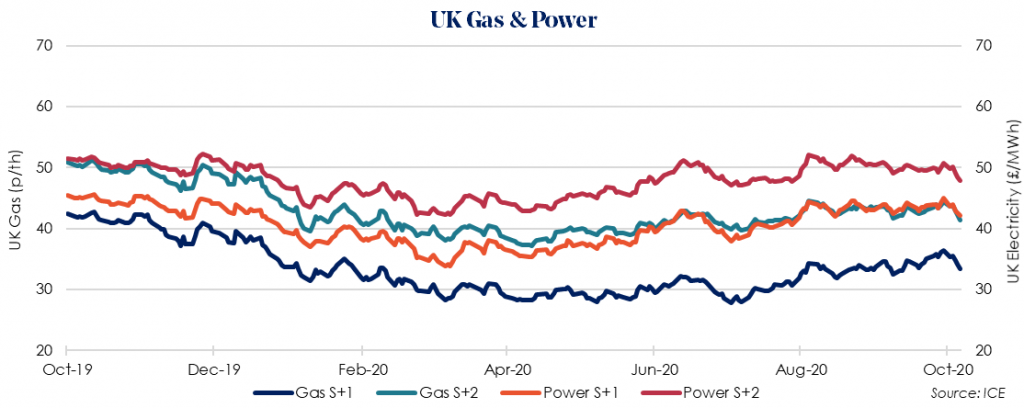

The UK’s Day-Ahead gas price fell by 16.4% to 34.70 p/therm. Increased supply from Norway saw continued gas storage injections this week, as maintenance disruptions eased. Continental Europe is forecast to see temperatures of 5 – 7°C above seasonal norms moving into next week, reducing demand.

Day-Ahead power fell by a further 10.8% to £37.50/MWh as wind output soared. More of the UK was placed under Tier-3 regional Covid-19 restrictions, with demand has also recording a significant drop.

Summer 2021 gas fell 8.6% this week, to 33.33 p/therm, as injections continue into UK gas storage.

Summer 2021 power prices saw a fall of 6.2% to £42.13/MWh, in line with the movement in carbon prices over concerns of Covid-19 undercutting European economic output and electricity demand.

Gas prices across Europe have seen a significant fall since last week’s 8-month high. Growing concerns of a second national lockdown in the UK, as well as in Germany and France, provide an increasingly negative forecast for energy demand.

Despite the restrictions, demand for gas should increase moving into the Winter as temperatures continue to drop and demand for heating increases.

Both gas and electricity contracts have seen a drop in prices this morning following news of a second national lockdown. It is likely that average prices will however rise again as we move further into Winter, therefore the recommendation remains to lock-in now or, if possible, wait until Summer 21.