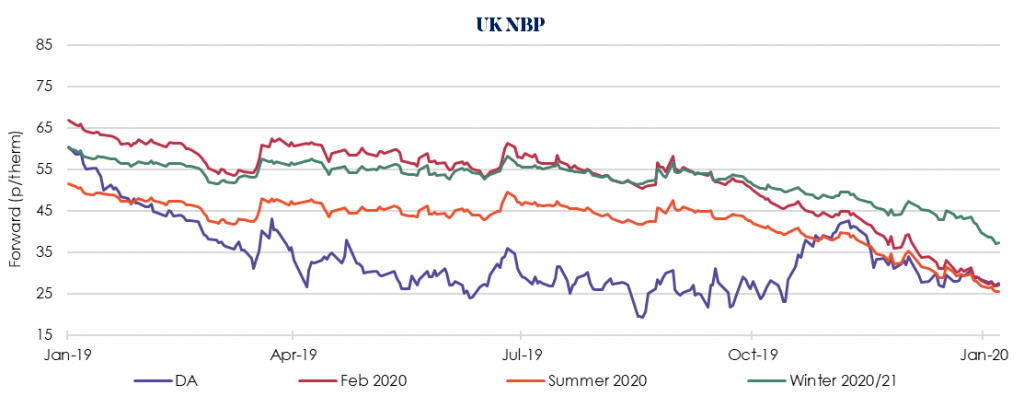

| p/therm | 17 Jan 20 | 24 Jan 20 | Change |

| Day-Ahead (DA) | 28.33 | 27.60 | -2.6% |

| Feb 2020 | 28.31 | 27.12 | -4.2% |

| Summer 2020 | 26.96 | 25.58 | -5.1% |

| Winter 2020/21 | 39.87 | 37.32 | -6.4% |

Source: Reuters

The UK’s Day-Ahead gas price fell 2.6% to 27.60 p/therm, as steady LNG imports, gas storage withdrawals and plentiful gas supply in Northwest Europe, countered Britain’s colder temperatures and undersupplied system.

Total LNG send-out rose to 70 mcm/d with six cargoes confirmed for delivery over the next month. However, this number is lower than normal thanks to the extremely high gas storage level in Northwest Europe, meaning that LNG imports are not needed as much.

Feb 2020 gas prices also fell 4.2% reflecting Europe’s well stocked gas storage, rising temperature forecasts for the first week of February and seasonally weak power demand. The significant growth in global LNG production year-on-year has meant that withdrawals from gas storage was limited until the start of 2020, leaving Northwest European energy markets well stocked during February’s peak winter month.

Despite being mid-January, EU gas storage is still at a whopping 75%, far higher than the 55% recorded at the same time last year.

The Summer 2020 gas price declined 5.1% week-on-week to 25.58 p/therm. The UK and Europe’s high levels for gas storage, combined with record deliveries of LNG and unseasonably wet weather in the Nordic region, mean the outlook for next summer’s supply and demand balance continues to look extremely comfortable.

UK NBP

| £/MWh | 17 Jan 20 | 24 Jan 20 | Change |

| Day-Ahead (DA) | 33.89 | 36.05 | 6.4% |

| Feb 2020 | 38.21 | 37.01 | -3.1% |

| Summer 2020 | 37.05 | 35.84 | -3.3% |

| Winter 2020/21 | 46.25 | 44.21 | -4.4% |

Source: Reuters

Day-Ahead power prices rose 6.4% to £36.05/MWh, reflecting weaker wind generation.

Summer 2020 power prices dropped 3.3% to £35.84/MWh in response to losses in the equivalent gas, coal and carbon markets. The lower cost of gas and coal means power production is expected to be less expensive over the next year.

There are also no major power plant outages across Northwest Europe. Plus, wet weather in the Nordic region is providing a significant boost to hydro generation supplied to Northwest Europe, reducing the demand for fossil fuels.

UK POWER BASELOAD

| $/bbl | 17 Jan 20 | 24 Jan 20 | Change |

| Brent Crude Mar 20 | 64.85 | 60.69 | -6.4% |

Source: Reuters

Brent crude oil prices fell 6.4% to $60.69/bbl as the death toll from China’s coronavirus rose and more businesses were forced to shut down, stoking expectations of slowing oil demand.

Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman Al-Saud said OPEC and its partners can help to balance the oil markets in response to any demand changes. Al-Saud also said Saudi Arabia, the de-facto leader of OPEC, was watching developments in China and that he felt confident the new virus would be contained.

Markets are being “primarily driven by psychological factors and extremely negative expectations, rather than fundamentals.

BRENT CRUDE OIL – MONTH-AHEAD

| £/$ | 17 Jan 20 | 24 Jan 20 | Change |

| GBP/USD | 1.3008 | 1.3076 | 0.5% |

Source: Reuters

The Pound Sterling was trading higher last week, rising versus the U.S. dollar and euro, after the release of official layout market figures that showed both a jump in employment and wages in December.

The strong numbers come in defiance of a recent run of soft economic statistics and will give policy makers at the Bank of England reason to keep interest rates unchanged and cast into doubt growing market expectations for a 30th January interest rate cut.

EXCHANGE RATE – GBP/USD (£/$)

Disclaimer: These views and recommendations are offered for your consideration and Beond makes every effort to ensure that the data and information in this report is accurate. However, due to the volatile and unpredictable nature of the energy markets, Beond cannot guarantee the accuracy of both the information and the recommendations provided. Beond does not accept any responsibility for errors or misstatements, or for any direct, indirect, consequential or other loss arising from any use of this information and/or further communication in relation to this information.