The UK’s Day-Ahead gas price saw an increase this week, by 43.6% to 13.00p/therm following previous concerns that the gas price was well below the cost of production. Looking into next week the price rises may continue as temperatures drop below seasonal norms. National Grid are also forecasting steady storage withdrawals into next week.

Day-Ahead power saw a decrease of 28.7% to £15.31/MWh following increased wind generation relative to last week.

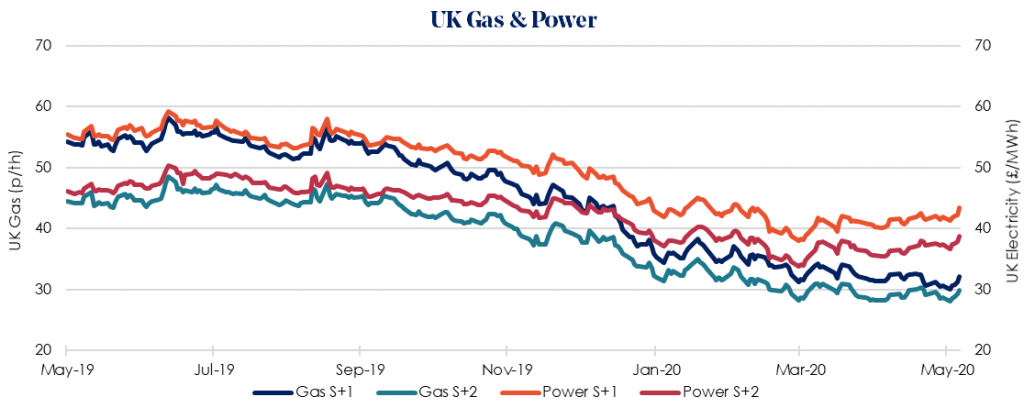

Winter 2020/21 gas has seen an increase of 4.8% to 32.11p/therm as, despite the gas system remaining acutely oversupplied, LNG send-out from the beginning of June has seen a clear step down.

This is due to reduced U.S. LNG supply and higher Asian demand causing reduced supply access for the UK. Combined with easing lockdown conditions across Europe near-term gas prices saw a significant increase and longer-term prices also saw a small rise.

However, Russian gas supply to Europe continues to increase following last week’s recovery from May’s closure, up to 730GWh/d from zero at the start of May. The UK gas system remains broadly well-supplied for this time of year.

Our recommendation remains to lock in contracts as soon as possible as prices begin to rise following the easing lockdown. This is compounded by economic uncertainty around a potential second wave of Covid-19.