The Oct 2021 Gas price rose 6.4% to 130.45 p/therm last week, as lower LNG inflows and supply disruptions from Russia’s YAMAL pipeline, together with strong storage injection demand (more than doubled from last year) were the key bullish drivers.

Meanwhile, Continental Europe is already experiencing low gas stocks, sitting at just 68% of maximum capacity (compared to 92% this time last year), and struggling to attract deliveries of LNG amid strong demand and record high prices in Asia.

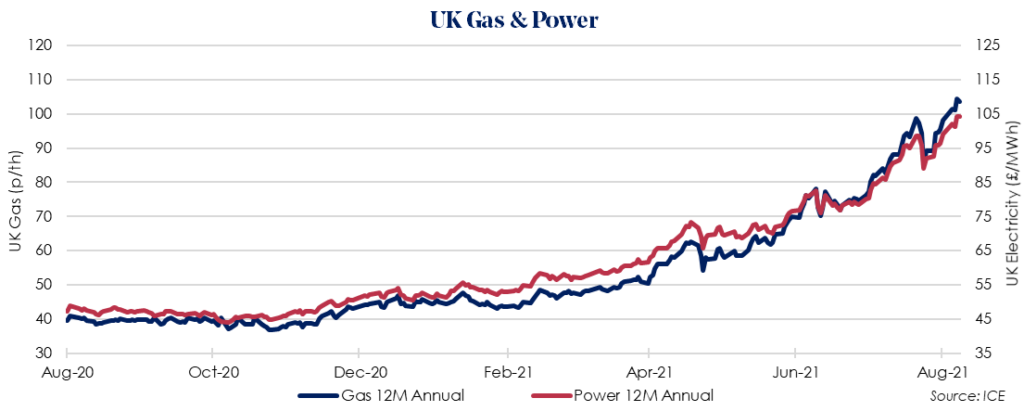

The Oct 2021 12 Month Gas price increased 9.5% to 104.44 p/therm as European gas contracts are trading near record highs, with gas storage levels lower than usual for this time of year and high prices in Asia leading to fewer deliveries of LNG heading to Europe. Just one tanker is currently scheduled to arrive in Britain this month.

Global LNG supply has been curtailed for the past few months due to prolonged maintenance in Russia and Australia, through the situation is improving.

The Oct 2021 12 Month Power price rose 5.2% to £104.21/MWh, tracking increases in gas, carbon and coal prices. Gas prices are now so high that we’re seeing gas-to-coal switching for power generation.

Prices for both gas and power continue to be supported by high levels of purchasing activity in the run up to the 1 Oct renewal date. With only 5 weeks to go, there is very little time for customers to lock out their 2021 supply contracts.