The UK’s Day-Ahead gas price fell 0.7% to 13.50p/therm last week despite colder weather and increased power demand as the UK gas system was oversupplied earlier in the week.

An expected rise in renewable generation over the weekend reduced gas-fired power demand, but planned maintenance on the Nordstream gas pipeline and low LNG send-out provided support to prices.

Day-Ahead power fell 2.0% to £27.29/MWh as wind levels rose towards the end of the week and as expected carried on over the weekend.

EDF revised their annual nuclear output estimates for 2020 which had a bearish impact on the Q4-2020 power contract price.

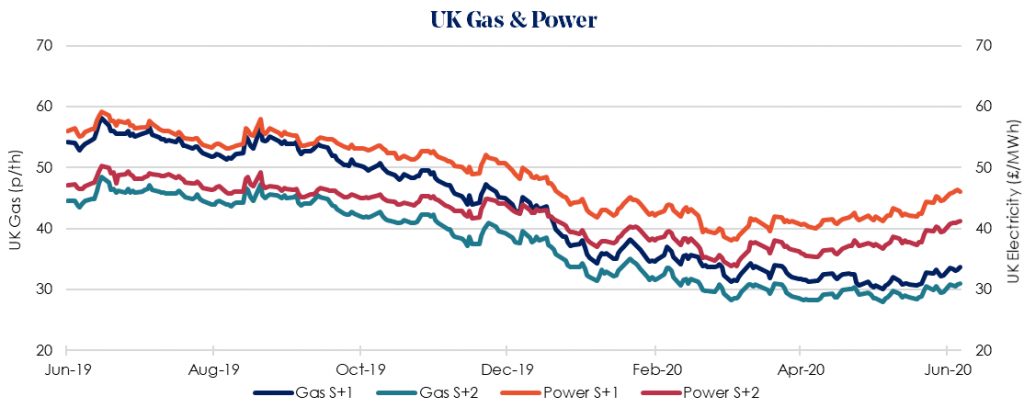

Winter 2020/21 gas rose by 3.9% to 33.64/therm supported by a rebound from overall European energy markets and a rise in global commodities and equities.

LNG prices also increased as a major shale gas producer in the US filed for bankruptcy.

Despite gains overall this week for Brent crude oil, the US set a new daily global record of 55,000 new Covid-19 cases on Thursday raising concern that fuel demand growth could stall again in the coming months.

Our recommendation remains to lock in contracts as soon as possible as prices gradually rise following the easing of lockdown restrictions.