The UK’s Day-Ahead gas price fell by 15.8% to 16.00 p/therm as the decline in demand due to the Covid-19 pandemic continues to hit the UK wholesale market. Measures to contain the spread of the coronavirus have led to an unprecedented loss in demand of up to a quarter of global consumption.

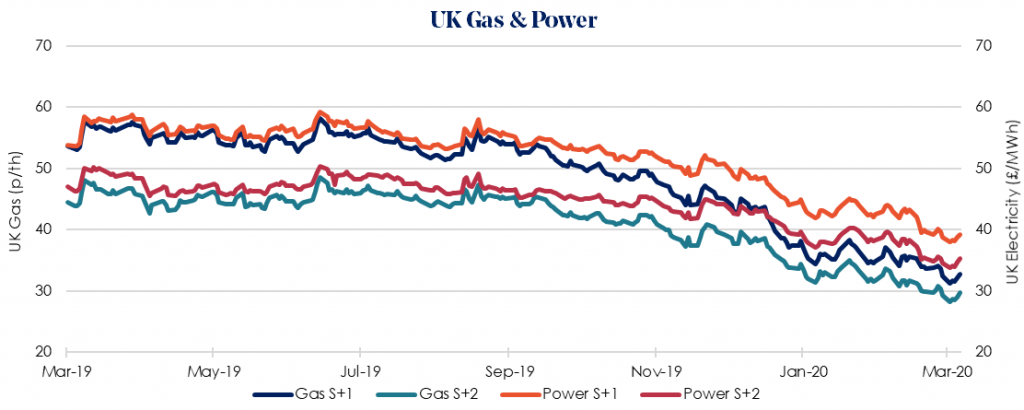

The Winter 2020 gas price rose by 0.9% week-on-week to 32.41 p/therm, with the equivalent Winter 2020 power price falling 1.3% to £38.71/MWh. Minor gains in the gas market were supported by a rally in oil prices on hopes of a cut to global supply whereas for power, a bearish expected rise in temperatures over the weekend offset the drop in renewable availability.

Pipeline gas flows from Norway to the UK fell 44% on Friday from the start of the week as the summer gas season. Pipeline gas flows to Britain fell to 50 mcm/d on Friday, down from 89 mcm/d on Monday.

Besides the massive decline in oil prices and reduction in demand the gas market is already under pressure from record-high stocks, which are currently 25% fuller than the average level at this time of year compared to the past five years. This is the result of last year’s record-high shipments, combined with a mild winter.

Seasonal contracts remain low and continue to fall. Sum-21 and Win-21 once again posted decreases across gas and power. Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.