The UK’s Day-Ahead gas price rebounded last week, gaining 23.4% to 13.20 p/therm as demand increased, in part due to cooler temperatures. The equivalent power prices were largely unchanged week-on-week as increased wind output and losses to the carbon market prevented similar sized gains.

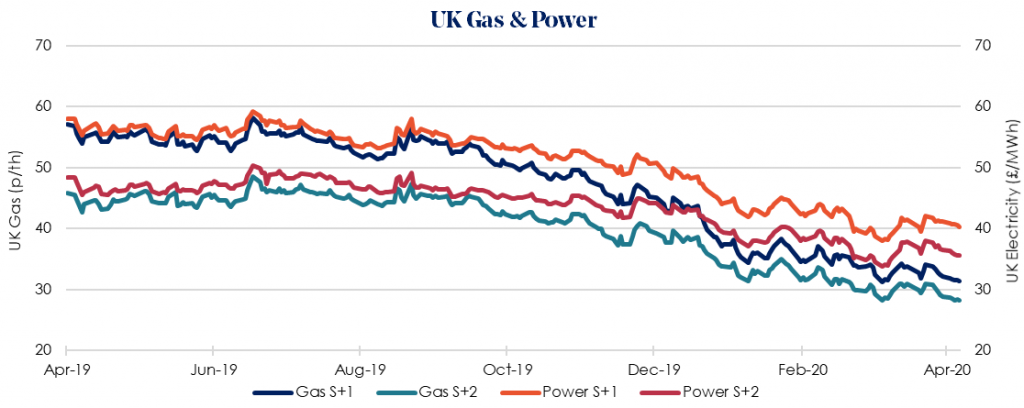

The Winter 2020/21 gas price slid 2.3% week-on-week to 31.32 p/therm, with the equivalent power price falling 2.2% to £40.29/MWh.

Pipeline gas flows from Norway to the UK remain low, but stable. Flows to Britain were at 32 mcm/d on Friday, a 3 mcm/d increase from Thursday.

Norwegian imports are expected to fall in the coming weeks, with scheduled maintenance taking place. FLAG pipeline maintenance from 7-25 May will reduce capacity by 15 mcm/d. Additional heavy work at Kollsnes will impact capacity by 107 mcm/d.

Low prices continue to persist, with the front of the curve dictated by healthy supply and storage levels, paired with reduced gas demand and low oil prices.

LNG send-out from South Hook saw highs of 59 mcm/d and is expected to remain strong in the first half of May, as 6 cargoes are now expected at the terminal in the next two weeks.

Seasonal contracts remain low and continue to fall. Sum-21 and Win-21 once again posted decreases across gas and power.

Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.