The Oct 2021 Gas price rose 14.2% to 122.61p/therm last week, after a German court ruling that the Nord Stream 2 (NS2) gas pipeline link with Russia must comply with EU rules requiring the owners of pipelines to be different from the suppliers of the gas that flows through them. This could delay the start of Nord Stream 2 deliveries but will not stop completion of the pipeline.

Meanwhile, Continental Europe is already experiencing low gas stocks, sitting at just 67% of maximum capacity, and struggling to attract deliveries of LNG amid strong demand and high prices in Asia.

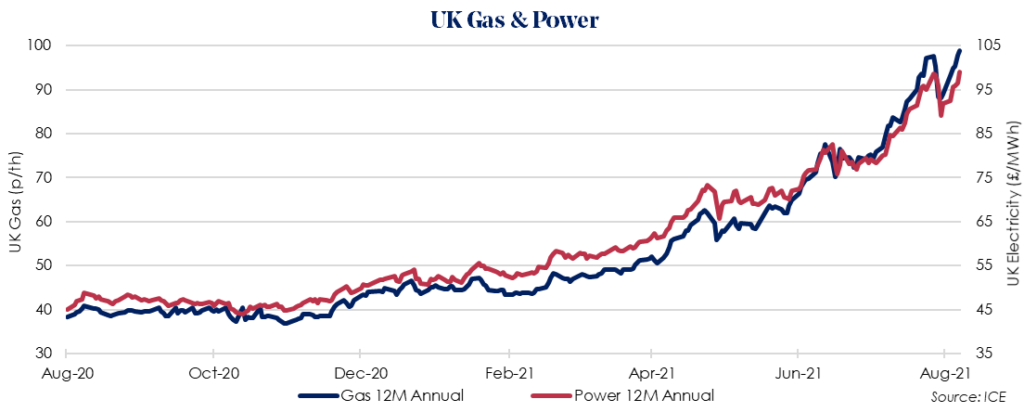

The Oct 2021 12 Month Gas price increased 11.0% to 97.83p/therm ahead of the UK bank holiday, amid concerns about the impact of storms on US LNG production.

Asia’s LNG importers expect high prices this winter on the back of tight demand-supply fundamentals, which could derail procurement plans and increase power prices, especially if temperatures drop sharply similar to cold snaps seen in the previous winter season.

The Oct 2021 12 Month Power price rose 7.7% to £99.05/MWh, tracking increases in gas, oil, carbon and coal prices.

Prices for both gas and power continue to be supported by high levels of tender activity in the run up to the 1 Oct renewal date. With only 5 weeks to go, there is very little time for customers to lock out their 2021 supply contracts.