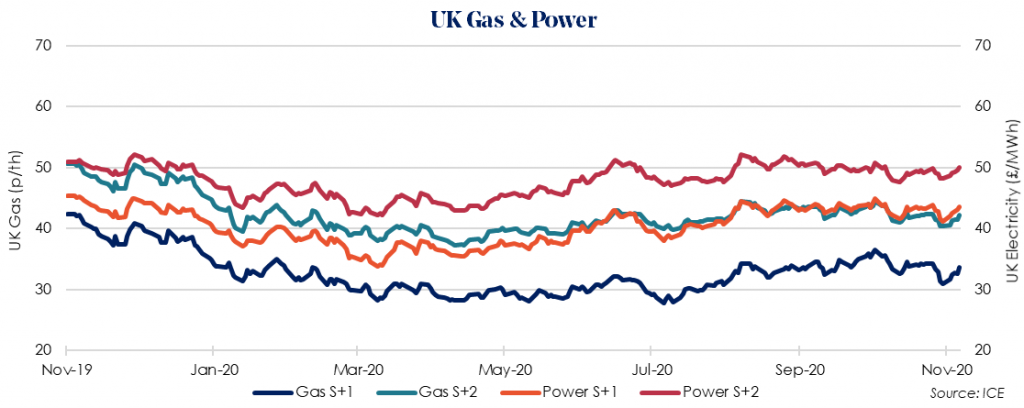

The UK’s Day-Ahead gas rose 20.6% to 41.30 p/therm as the temperature outlook forecasts colder weather on the way as we approach the end of the UK’s second national lockdown. The National Grid predicts the gas system to be 10.9% oversupplied moving into this week.

Day-Ahead power rose by 27.1% to £48.91/MWh. The gain was a result of low wind and hydro generation, a colder weather outlook and many people in the UK expected to return to workplaces this week providing an expected boost to power demand.

December 2020 gas saw a significant rise of 15.1% to 41.68 p/therm. Gas prices have been boosted by the possibility of an effective Covid-19 vaccine. The oversupplied gas system tightened following a significant rise in gas-fired power generation this week. Temperatures are also expected to fall further in the coming weeks.

December 2020 power also saw a rise of 13.3% to £48.81/MWh following bullish movements of gas, carbon and coal.

Summer 2021 gas and power also saw rises of 8.6% and 5.8% respectively, as optimism that the rollout of an effective vaccine may begin to increase global demand as early as next summer, boosting gas, power, and oil prices.

It is likely that average prices will continue to rise as we move further into winter, therefore the recommendation remains to lock-in now or, if possible, wait until Summer 21.