The UK’s Day-Ahead gas price rose by another 8.7% to 25.00 p/therm. This has been due to the UK system being undersupplied as consumption was higher than expected, a result of temperatures dropping below normal today.

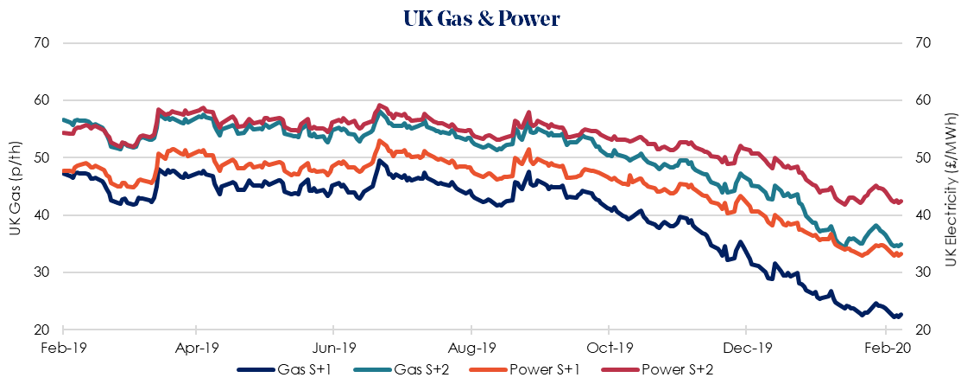

The Summer 2020 gas price fell by 4.5% week-on-week to 22.65 p/therm, with the equivalent power contract matching the trend in gas falling 3.7% to £33.22/MWh. The worries surrounding coronavirus and its impact, potentially slowing global economy, is a significant factor for bearish prices this week. These current trends are however still based largely on speculation of what’s to come, an indicator of expected future market volatility.

All in all, bullish drivers on price are dominated by the cooler than expected temperatures. The weather also continues to play its role with high wind speeds having allowed only three LNG offloads across Dragon and South Hook terminals. However, prices have become bearish as several cargoes are lined up awaiting the forecast drop in wind speeds.

Brent crude oil fell 13.6% to $50.52/bbl last week as a growing number of coronavirus cases worldwide hit forecasts for global economic and energy demand. The list of countries directly impacted by the illness has climbed to nearly 60 with more than 82,000 people worldwide contracting the illness.

In other news, after almost 50 years, coal-fired electricity generation at Drax Power Station is expected to come to an end in March 2021 – marking a major milestone in the company’s world-leading ambition to become carbon negative by 2030.

The UK government have also said it will not appeal against a court ruling that Heathrow airport’s £14bn project to build a third runway was unlawful on environmental grounds as the government had failed to take into account commitments made under the 2016 Paris agreement on climate change when assessing Heathrow’s expansion plan. The Court of Appeal ruled that this made the government’s airports policy unlawful.