The April 2021 Gas rose 12.3% to 48.39 p/therm last week as a shipping vessel ran aground in the Suez Canal causing major disruption and delays to LNG deliveries. Meanwhile, scheduled maintenance at UK and Norwegian gas production facilities reduced imports further. This disruption outweighed the effect of unseasonably warm European temperatures forecast for the start of April.

The April 2021 Power rose 4.8% to £57.21/MWh as wind generation remained low for the majority of last week increasing reliance on gas-fired power generation. This caused power to follow the gains in gas.

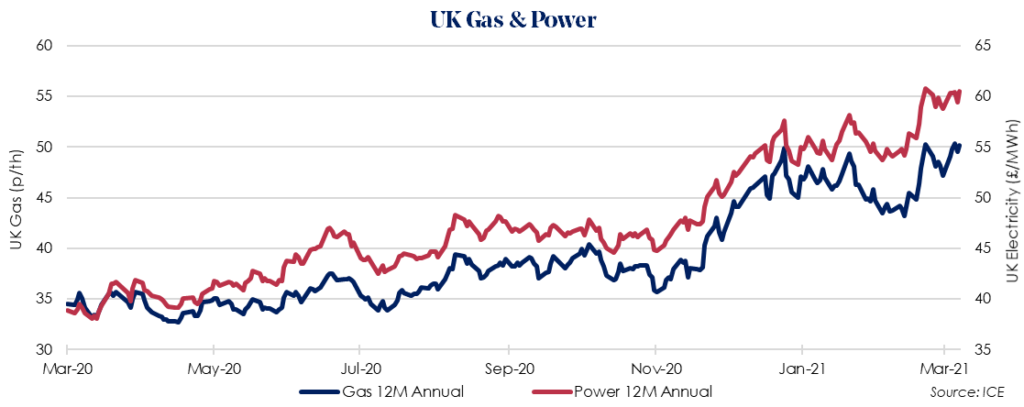

The April 2021 12 Month Gas price rose by 6.3% last week to 47.19p/therm with near term supply concerns caused by the Suez Canal disruption of LNG deliveries boosting Summer 21 prices. Some bearish pressure from a fall in carbon limited Winter 21/22 price gains.

European Gas storage remains at its lowest level for the past 3 years. However, despite the supply disruption, milder weather across Europe has caused a reduction in demand and led to some injection this week. UK Gas storage increased 2.8% and is now at 33.6%.

The April 2021 12 Month Power price rose by 3.0% to £60.52/MWh last week tracking the equivalent gas contract. Gains were weaker than for gas as a strong renewable outlook for the start of this week provided some resistance for near term power prices. Winter 21/22 price gains were also limited by a fall in carbon.