The UK’s Day-Ahead gas price fell 2.9% to 13.60p/therm last week as a warm temperature and a rise in solar power reduced short term demand for gas-fired power demand. Weak gas demand and an increase in domestic gas production resulted in a heavily oversupplied UK gas system.

Gas flows to the UK via the Langeled pipeline rose this week with a total of 50 mcm of Norwegian gas delivered to Britain on Friday contributing to the UK gas systems oversupply.

Day-Ahead power fell 6.5% to £27.86/MWh as a surge in Coronavirus cases in the US and the on-going US ‘trade war’ with China impact global markets. Warmer temperatures, strong solar and wind generation as well as weakening equities and other commodities have helped to weaken power contracts.

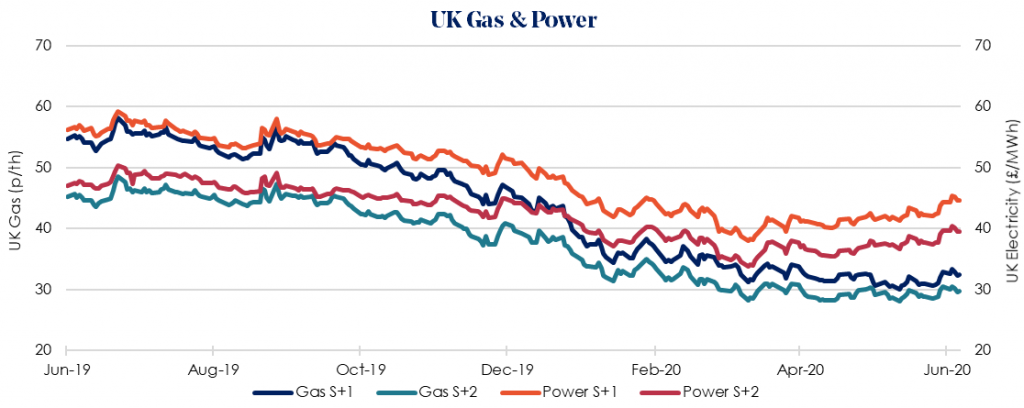

Winter 2020/21 gas fell by 1.4% to 32.38/therm following a dip in oil prices. Both oil and gas storage are extremely comfortable. Meanwhile, concerns grew that a record rise in Covid-19 infections worldwide could stall a recovery in fuel demand.

Concerns of slightly increased levels of radioactivity detected in northern Europe by Nordic authorities this week may be from a source in western Russia and may “indicate damage to a fuel element in a nuclear power plant.” It is unclear whether there will be any further ramifications on this across Europe’s power sector.

Our recommendation remains to lock in contracts as soon as possible as prices begin to rise following the easing of lockdown restrictions.