The July 2021 Gas price rose 11.2% to 79.88p/therm last week as low supply from the UK’s LNG terminals and strong demand from the power sector led to an undersupplied market.

LNG prices in Asia and Europe have been on the rise on firmer demand as warmer than usual temperatures for this time of year in different parts of the world boosted electricity usage for air conditioning.

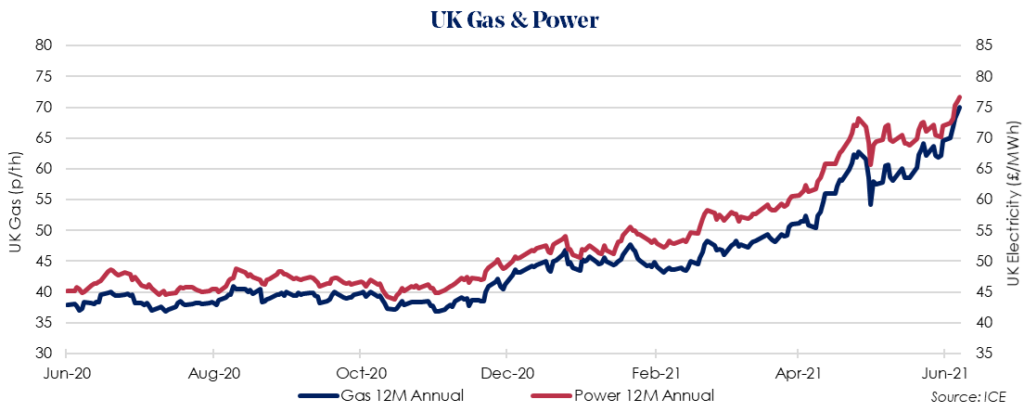

The Oct 2021 12 Month Gas price rose 8.2% to 69.96p/therm as Europe continues to face an uphill battle to refill gas storages before next winter.

European storage levels are currently 46% of full capacity, still well below the 5 year normal in late-June, raising concerns that storage will not be completely filled when winter begins.

Ongoing summer gas maintenance at several North Sea terminals continues to limit supply, as UK and Norwegian pipeline flows are below capacity.

The Oct 2021 12 Month Power price saw an increase of 6.5% to £76.63/MWh, tracking gas prices higher.

In related markets, Renewable Energy Guarantee of Origin (REGO) prices have jumped to a premium of c. 0.2 p/kWh, around 50% higher than in January 2021, as market sentiment remains broadly positive.

The positive sentiment around REGO growth will continue, with prices set to continue to increase over the next year as electricity demand fully recovers to pre-pandemic levels.