The UK’s Day-Ahead gas rose 3.0% to 41.50 p/therm. Although temperatures have been above seasonal norms, the general trend of falling temperatures will cause an increase in heating demand. Supply to the UK also fell after the spread between UK and Dutch prices narrowed, from 1.8 p/therm to 0.5 p/therm.

Day-Ahead power fell by 10.9% to £42.04/MWh as forecasts for high-pressure weather and clear skies should help generation from renewable power sources.

Summer 2021 gas increased 4.2% this week, to 36.46 p/therm despite UK gas storage levels sitting around 92%, bolstered by recent injections. UKCS and Norwegian gas production is still forecasted lower, with increased regulation limiting Dutch production.

Summer 2021 power prices rose 2.7% to £44.93/MWh, mirroring the movement in gas prices, supported by increases in carbon and coal prices.

The UK gas system looks to be balanced currently, with LNG send out up compared to the end of last week. However, upwards price movements are expected this week after Dragon receives cargo today, with send-out lower across the rest of the week.

Norwegian imports are currently up relative to last week, despite maintenance at Kollsnes until the end of the month with an expected impact of 37 mcm/d.

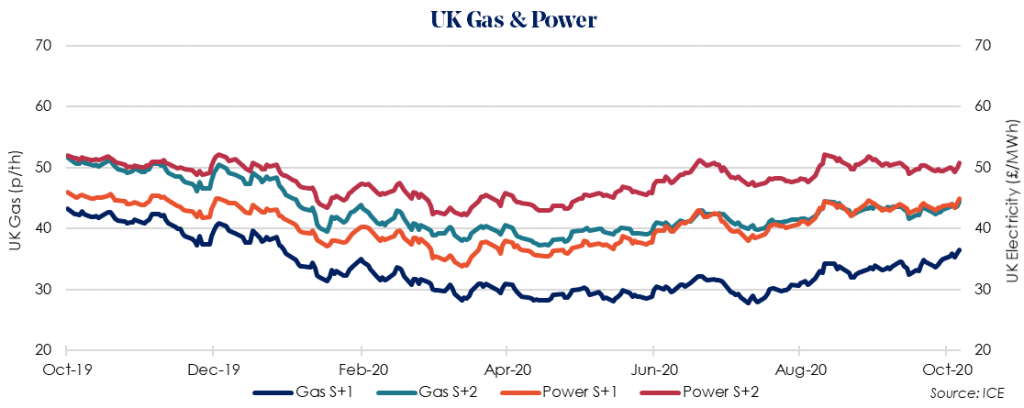

October may be the last opportunity to lock in contracts while energy prices remain low for customers renewing in early-2021. But if your energy contracts are not renewing until Oct-2021, there may be another opportunity for you during summer 2021.