The UK’s Day-Ahead gas price continued to fall last week, by 24.4% to 9.3p/therm, the lowest price in over a decade.

Day-Ahead power also saw a record drop to -10.13 £/MWh as exceptional wind-power generation coincided with the bank holiday weekend, exacerbating continued low demand.

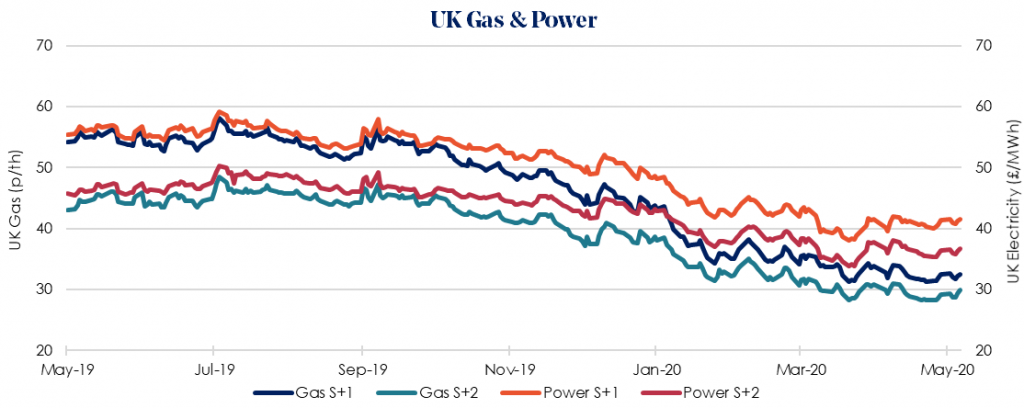

Winter 2020/21 gas saw a drop from last week, down 5.7% to 30.63 p/therm. The equivalent power price was stable at 41.38 £/MWh.

European gas prices are being described as sitting in ‘no man’s land’, with several forward contracts being priced below average production costs. With no sign of an easing supply or increasing demand, going into the summer, the acute oversupply becomes more pronounced.

Gas prices are expected to remain neutral this week with warmer weather reducing demand and less windy weather increasing the need to gas to power generation causing a balanced price. Three LNG tankers are also due this week, injecting supply which remains well above the 5-year average.

As the gas system gets well into ‘injection season’, whereby supply outweighs demand, the dramatically reduced demand indicates remedial action will be required before the end of the Summer to maintain prices.

Our recommendation remains to lock in contracts before June 2020 ahead of expected long-term volatility due to economic slowdown.