The Aug 2021 Gas price rose 3.5% to 88.44p/therm last week, as Norwegian outages resulted in lower supply to the UK and Europe.

Lower wind output and LNG send-out also means there is less gas being injected into storage as it is needed to meet current high demand.

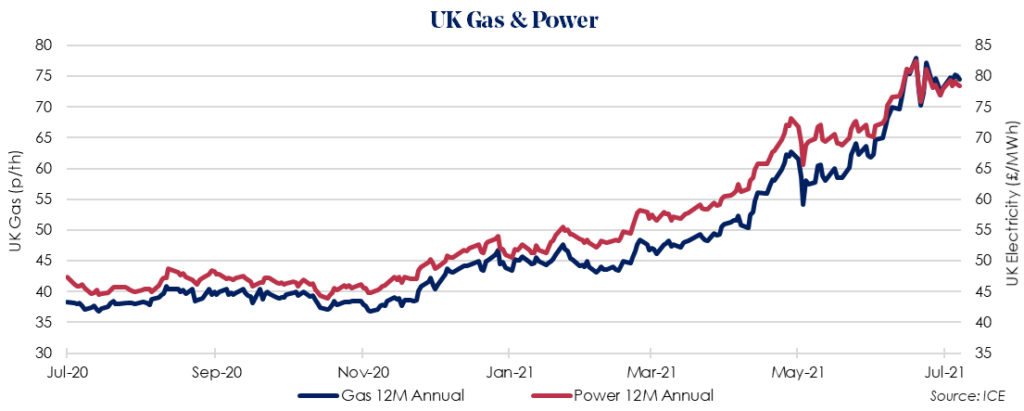

The Oct 2021 12 Month Gas price increased 1.7% to 74.48p/therm concerns over winter supply. Since European gas storages are still only 54% full this continues to be the largest supply risk ahead of the colder winter period.

An agreement between the United States and Germany over the Nord Stream 2 gas pipeline from Russia was reached last week, easing concerns over long term supply to Europe. The construction of the pipeline could be completed in September. This may prevent possible gas shortages during the upcoming winter season.

The Oct 2021 12 Month Power price rose 0.4% to £78.42/MWh, tracking gas prices higher but declines in carbon ultimately capped power gains.

Once again, prices for both gas and power are still being supported by high levels of tender activity in the run up to the 1 Oct renewal date.

The months of July, Aug and Sept are the busiest in the industry, meaning any clients who haven’t yet secured their new contracts will all be asking suppliers for prices at the same time, supporting high prices.