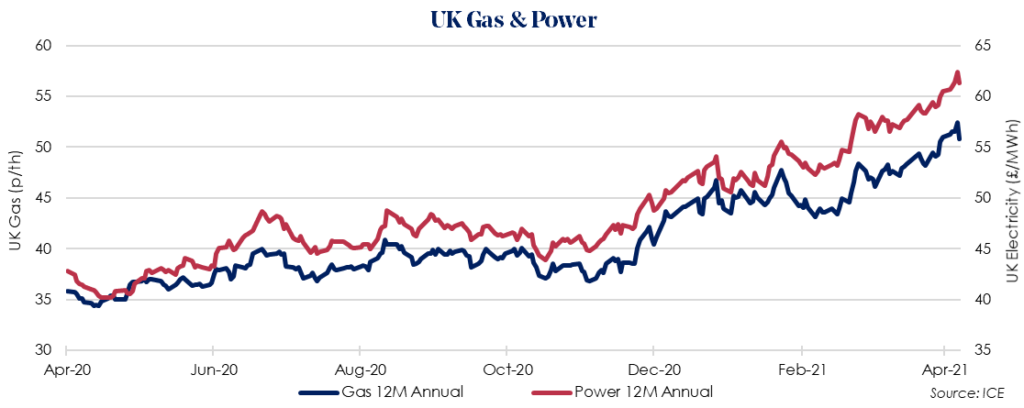

The May 2021 Gas price fell 0.8% to 50.72p/therm last week. Gains in oil prices early in the week caused upward pressure on the wider energy market before a well-supplied gas system meant prices ended the week lower. Healthy LNG send-out, supported by a high number of deliveries in April, and strong pipeline flows have helped bring down near term prices.

The May 2021 Power price continued to climb, gaining 1.3% to £61.43/MWh. Cooler forecasts and weak renewable generation, especially from wind, have provided support for power prices in recent weeks. At the end of last week, EDF announced a short delay in French nuclear facilities coming back online following maintenance, providing additional price support.

Gas and power prices also continue to be bolstered by carbon prices, which once again reached record highs last week.

The Oct 2021 12 Month Gas price was largely unchanged last week, falling 0.2% to 50.84/therm. European gas storage remained at around 29%, while UK Gas storage saw a small net injection, rising to 19%. Colder weather than normal is resulting in gas withdrawals later than previous years. This time last year, European gas storage was around 61% full.

The Oct 2021 12 Month Power price rose 1.4% to £61.31/MWh, supported by strong carbon prices and on optimism of future demand recovery, as the UK’s Covid vaccine rollout has now seen over 33 million people receive their first dose.