The February 2021 Gas contract saw a rise of 1.3% last week in response to cold weather forecasts which could carry over into February. UK temperatures are expected to average over 4°C cooler than normal until Wednesday, increasing gas for heating demand.

The February 2021 Power contract fell 1.2%, amid news that the 1GW IFA2 interconnector between the UK and France has become fully operational, capable of delivering just over 1% of the Britain’s electricity needs. It is also reported the 1GW BritNed interconnector between the UK and Netherlands will be back online 7th February, after a two-month outage.

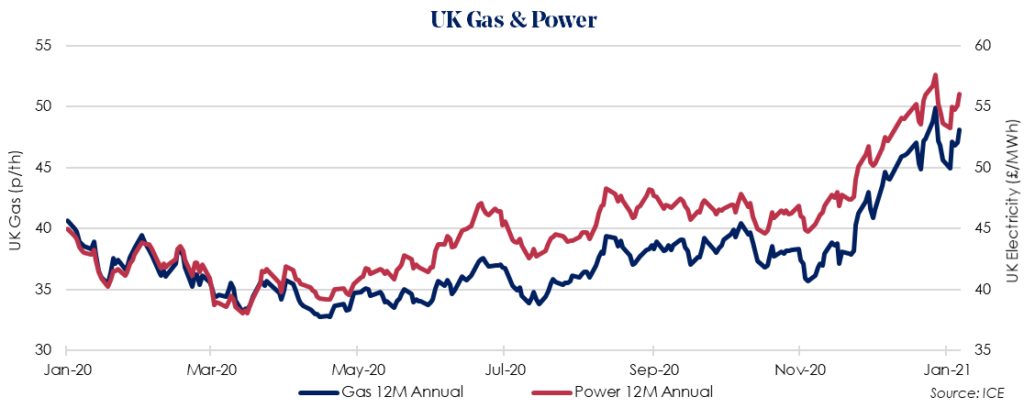

The April 2021 12 Month Gas price climbed 5.4% last week, amid concerns potential cold weather in February will coincide with low storage levels across Europe. European storage levels are currently around 60% full and below the 5-year average.

LNG prices have eased, as cold weather in Asia looks to have subsided, with forecasters expecting mild weather compared to seasonal norms. Delivery focus for the region has shifted to March and April, helping improve supply to Europe, easing recent bullish sentiments.

The April 2021 12 Month Power price rebounded on previous loses, gaining 4.5% last week, mirroring gains in the equivalent gas contract, while carbon prices also strengthened.