The UK’s Day-Ahead gas price rose by 7.2% to 23.00 p/therm. This is due to both a technical rise as the market reached its nadir, cooling temperatures and LNG imports being hindered by bad weather.

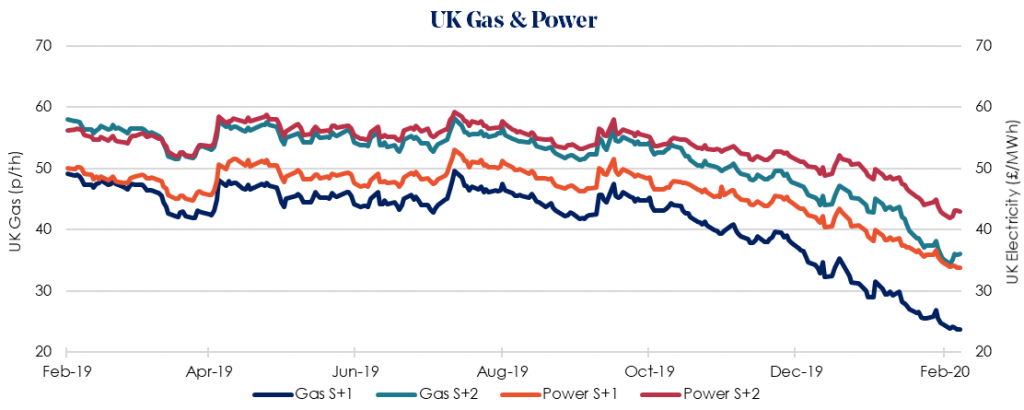

The Summer 2020 gas price increased by 1.8% week-on-week to 23.73 p/therm, with the equivalent power contract increasing by 2.4% to £34.50/MWh as cooler February temperatures take hold.

The tide appears to be turning on the recent falls in Gas and Power prices as the Winter begins catching up with us. A key reason for the increase in gas prices is due to high wind speeds disallowing cargoes to unload at Milford Haven. This undersupply is somewhat mitigated by Norwegian pipe gas flows increasing by 10 mcm per day.

Another bullish driver on gas prices is bolstered by news that Groningen gas field, the largest in Europe and 10th largest in the world, will cease production sooner than anticipated under fears of earthquake risk. Production has already been dropped by a further 15% from 11.8 bcm to 10 bcm.

Eleven LNG tankers are scheduled to arrive in Britain over the coming week set to bring a total of 2.3 mcm of LNG into the UK.

Seasonal contracts are mixed, with S-20 and W-20 remaining low, however now climbing. S-21 and W-21 are steady with power becoming static and gas showing a marginal decrease. Our recommendation is to lock in contracts before June 2020 ahead of further price climbs.