The UK’s Day-Ahead gas fell 5.3% to 18.75p/therm as energy demand fell alongside temperatures last week. Increased renewable generation from wind and solar also reduced the demand for gas-powered electricity generation.

Day-Ahead power fell much further with a -13.3% change to £29.58/MWh as renewable generation rose well above average levels for this time of year.

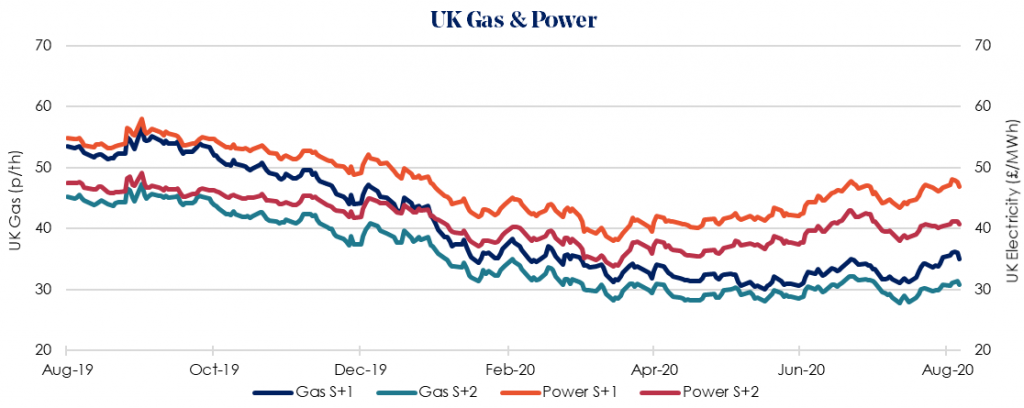

Winter 2020/21 power prices moved laterally with a small rise of 0.5%. Currently, forward power contracts are linked closely to the carbon price. Carbon remains broadly flat despite earlier thoughts its value would rise alongside action towards a ‘Green Recovery’ from Covid-19. Concerns of a second wave of lockdown seem to be the main driver weighing down on price rises.

Winter 2020/21 price movement was mixed. Gas edged 0.9% lower last week to 34.99 p/therm on comfortable supply. However, unplanned maintenance at Kollsnes has reduced Norwegian flow volumes a further 20%. As a result, gas prices are forecast to rise as the week develops.

Three shipments of LNG are set to arrive in the UK this week, two from Qatar and one from Norway, accounting for reduced pipe flows. LNG price rises are being called ‘deceiving’ as the US makes plans to cut output with little incentive for other LNG producers to take the slack.

UK gas storage continues to trend back towards the 5-year average range amidst flow maintenance placing the UK system 25mcm/d undersupplied.

Our recommendation remains to lock in contracts as soon as possible as prices are at risk of further volatility following the easing of lockdown restrictions.