The UK’s Day-Ahead gas fell by 9.9% to 34.25 p/therm as the temperature outlook remains above seasonal norms. The National Grid predicts the gas system to be 8.9% oversupplied moving into this week.

Day-Ahead power fell by 9.0% to £38.47/MWh following strong wind generation despite speculative trading keeping carbon prices higher than expected.

December 2020 gas saw a significant fall of 10.1% to 36.21 p/therm as demand forecasts remain low due to warm temperatures and UK gas storage hitting 100% on Friday (20th Nov).

Summer 2021 gas also saw a large fall of 9.6%, to 30.93 p/therm largely due to LNG oversupply and European temperatures averaging 1oC above seasonal norms.

Low global LNG prices have been the main driver of weakening gas, and to some extent, power prices this week, largely as an indicator for the state of the gas market. The UK has 8 LNG deliveries scheduled for the next fortnight, with 5 of these coming from the US. The election of Joe Biden as the has caused a stir of fear amongst US shale as shale gas incentives appear to be in the crosshairs for the future 46th President of the United States. This has caused US LNG producers to sell now before the market is weakened, leading to a global oversupply.

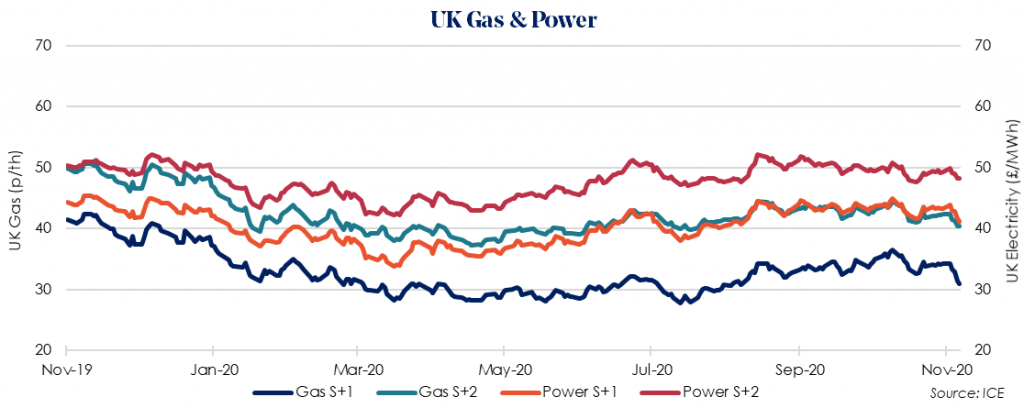

Gas and Electricity contracts have fallen as LNG supply has spike. Despite this, it is likely that average prices will continue to rise as we move further into winter, therefore the recommendation remains to lock-in now or, if possible, wait until Summer 21.