The UK’s Day-Ahead gas price fell by 3.5% to 23.15 p/therm as higher LNG send-out and Norwegian pipeline imports created an oversupplied market. Higher wind outputs also reduced demand from gas-to-power plants.

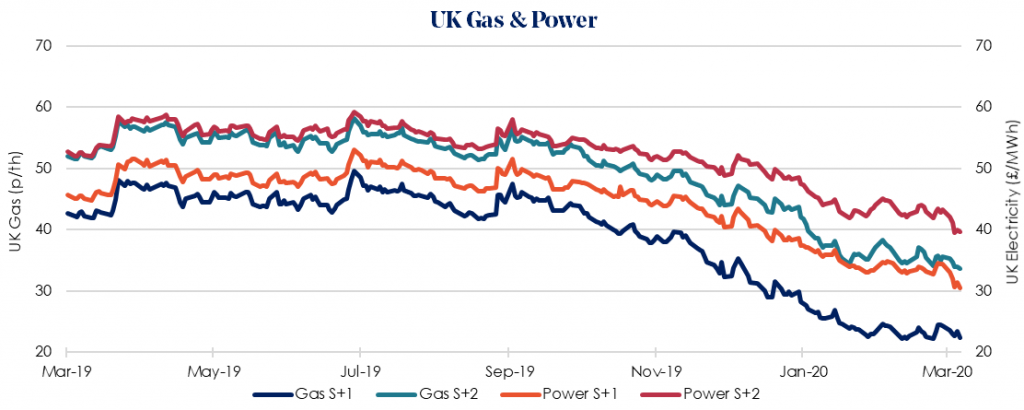

The Summer 2020 gas price fell by 8.1% week-on-week to 22.38 p/therm, with the equivalent Summer 2020 power seasonal price falling 11.3% to £30.45/MWh. UK and European demand have been significantly decreased as the bearish effects from the spread of coronavirus (Covid-19) are felt across the continent. Fears of a UK-wide lockdown like those already seen in Italy, Spain and France help to weaken demand in an already weak gas market.

Bullish drivers this week are mainly due to below normal temperatures recorded towards the end of the week and forecast to continue into next week.

There were various bearish drivers this week caused by the current global pandemic. US futures saw their worst trading day since 1987 this week impacting markets all over the world, the price of jet fuel and gasoline fell below the cost of crude production making the refining process unprofitable. Further reduction in demand is expected across Europe as the spread of Covid-19.

Seasonal contracts overall remain low. Unlike last week, Sum-21 and Win-21 posted significant decreases across gas and power as the duration and longer-term effects of the Coronavirus outbreak are realised. Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.