The April 2021 Gas price fell 9.3% to 43.10 p/therm last week following the end of unplanned Norwegian outages and an expected rise in temperatures. The gas system was oversupplied last week from a return to expected LNG deliveries as high winds eased allowing ships to dock and offload, meanwhile demand forecasts weakened.

The April 2021 Power fell 5.4% to £54.50/MWh last week, despite low renewable output, following the downward movement of equivalent gas prices and a healthy supply and demand balance.

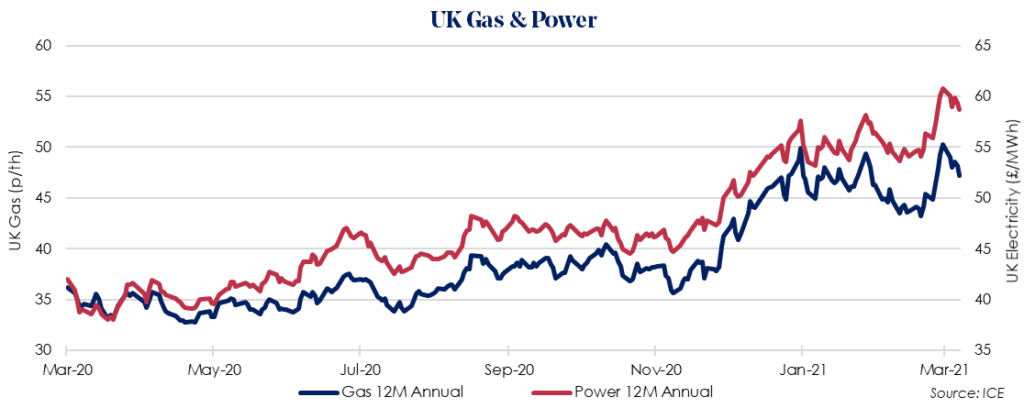

The April 2021 12 Month Gas price fell by 6.0% last week to 47.19p/therm. Both Summer 21 and Winter 21/22 saw declines as supply concerns eased at the start of the week. Milder weather forecasts for March and the biggest daily drop in six months for Brent Crude prices provided further bearish pressure.

European Gas storage remains at its lowest level for the past 3 years with a further 2% decline last week. Meanwhile, UK Gas storage increased 2% last week. The UK is expecting 7 LNG deliveries this week.

The April 2021 12 Month Power price fell by 3.4% to £58.73/MWh last week following losses in gas, carbon and an ample gas supply. Some resistance was provided by a drop in renewable output, due to weak wind and solar generation. A small rise in coal also provided further support for Winter 21/22 prices.