The UK’s Day-Ahead gas rose 9.0% to 29.80/therm with temperatures expected to fall significantly at the start of this week as we head into Autumn.

Day-Ahead power increased slightly, gaining 0.7% to £37.95/MWh as weak renewable generation was forecast for the start of the week.

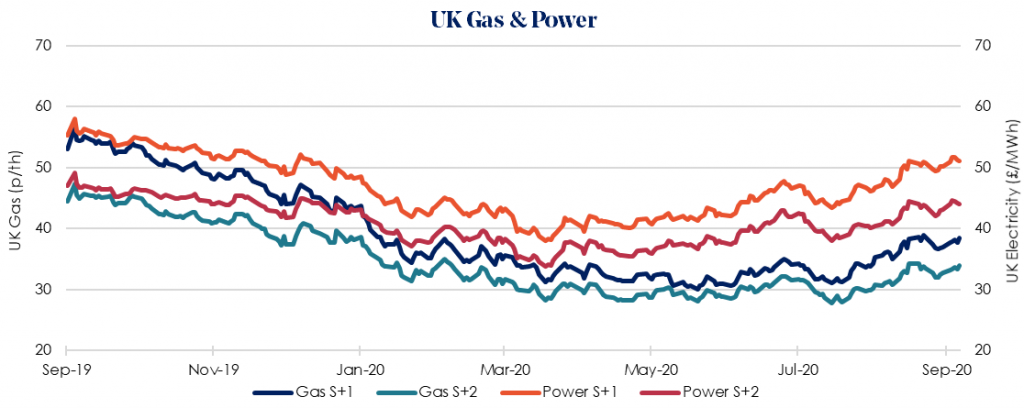

Winter 2020/21 power prices increased by 1.9% to £51.06/MWh. Carbon continued to pressure power prices across the UK and Europe last week. New carbon targets are expected to be imposed by the EU which is expected to dictate power prices in the coming months. A drop in temperatures is also expected as we head into October providing further support for prices.

Winter 2020/21 gas gained 3.8%, rising to 38.39p/therm, following increases in coal and oil. Warmer and less windy weather across the UK and Europe last week caused UK demand to inch lower but the fall in demand was offset by higher gas-for-power generation due to weak wind power production, outages and maintenance.

Dutch gas flows via the BBL pipeline halved due to a planned full shutdown for the majority of last week. Gas pipeline imports into Britain were suppressed following maintenance outages at Norway’s major Nyhamna and Troll gas fields.

The UK also experienced restrictions at several gas terminals, lowering domestic production. However, UK Continental Shelf gas production is expected to increase this week.

There’s little more than a week remains before the start of Winter 20/21 contracts. Temperatures are set to plummet this week so our recommendation for clients with open Winter volume remains to lock this in as soon as possible.