The UK’s Day-Ahead gas price fell 0.8% to 12.90p/therm last week as temperatures fluctuated around seasonal normal for most of the week. A notable fall in carbon prices towards the end of the week also caused downward pressure on prices

Day-Ahead power fell 1.1% to £28.27/MWh, again in part due to carbon prices. Across Europe, spot power prices slid as demand was lower than forecast, while renewable generation also ticked up.

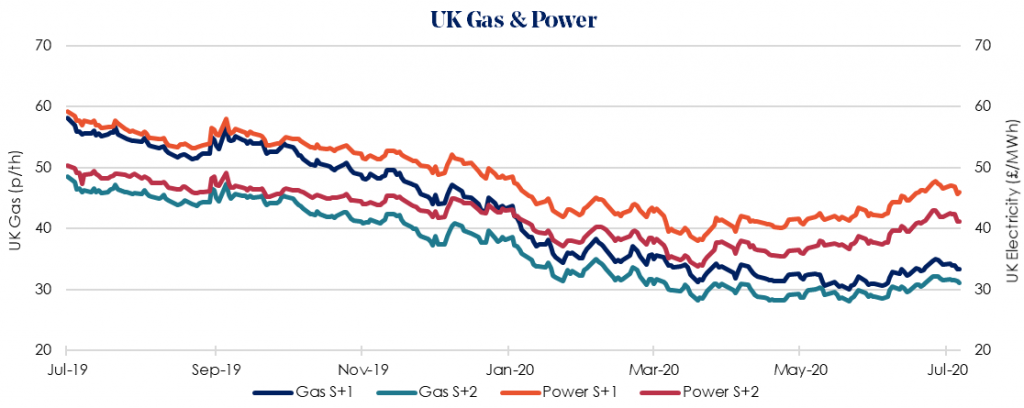

Winter 2020/21 gas fell 2.0% week-on-week to 33.35 p/therm, with the equivalent power price falling 1.5% to £45.93/MWh, as a report from The Academy of Medical Scientists predicted a second wave of Covid-19 could peak in January and February, potentially impacting energy demand. The UK’s chief scientific adviser said there is a high degree of uncertainty over how the pandemic will play out over the winter, which will weigh on prices.

Week-on-week losses were seen across the forward energy market, as the U.S. set another one-day record of 77,000 coronavirus cases on Friday, raising concern that global fuel demand growth could stall again if we experience a second wave.

Gas storage remains strong with facilities up to 84% full, compared to 63% typically seen at this time of year. July has so far had four arrivals of LNG tankers, with two more currently scheduled.

Maintenance is expected at fields delivering to the SEGAL pipeline towards the end of the month, reducing capacity by 15mcm/d for two days.

Our recommendation remains to lock in contracts as soon as possible as prices gradually rise following the easing of lockdown restrictions.