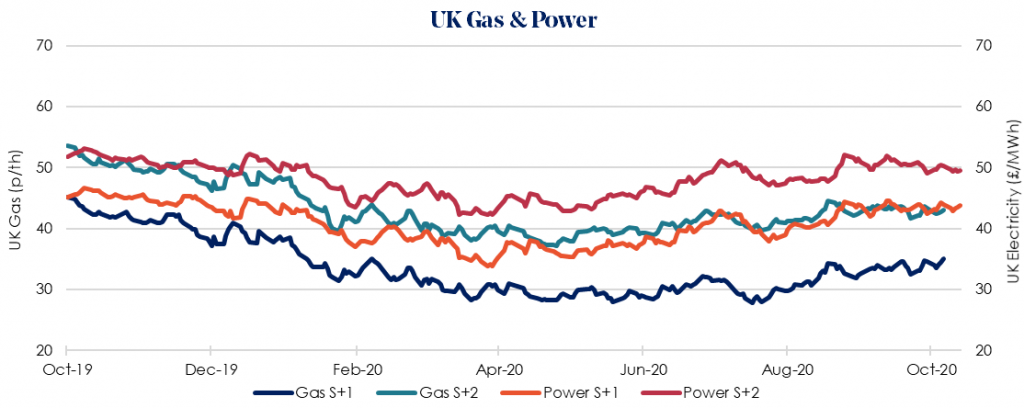

The UK’s Day-Ahead gas rose 5.5% to 40.51 p/therm as colder weather this last week increased heating demand. However, Norwegian gas strikes ended after a wage agreement was reached, meaning production is unlikely to be restricted going forward.

Day-Ahead power rose by 13.7% to £47.18/MWh as low-pressure weather continues to create unsettled weather conditions and hinder solar generation across much of Britain. Meanwhile, despite new Covid-19 restrictions it is unlikely these will unduly hinder UK power demand, at least in the short term.

Summer 2021 gas increased 1.3% this week, rising to 35.00 p/therm as UK gas storage hovers at around 77% of normal capacity, slightly below normal for this time of year. UKCS and Norwegian gas production is also forecasted lower, with increased regulation also limiting Dutch production.

Meanwhile, Britain’s largest supplier of LNG has secured a 25-year contract to continue supplying gas to the UK’s Isle of Grain LNG terminal.

Summer 2021 power prices fell 0.3% to £43.73/MWh following declines in coal and carbon. However, there’s a risk that if Britain is unable to reach an agreement with the EU over a long-term trade deal, that the value of the Pound Sterling could be at risk.

October may be the last opportunity to lock in contracts while energy prices remain low for customers renewing in early-2021. But if your energy contracts are not renewing until Oct-2021, there may be another opportunity for you during summer 2021.