The Aug 2021 Gas price fell 5.0% to 85.48p/therm last week, reflecting lower demand and as domestic production was expected to increase.

Temperatures in Britain are rising and the Met Office predicts more warm weather is expected through July and August.

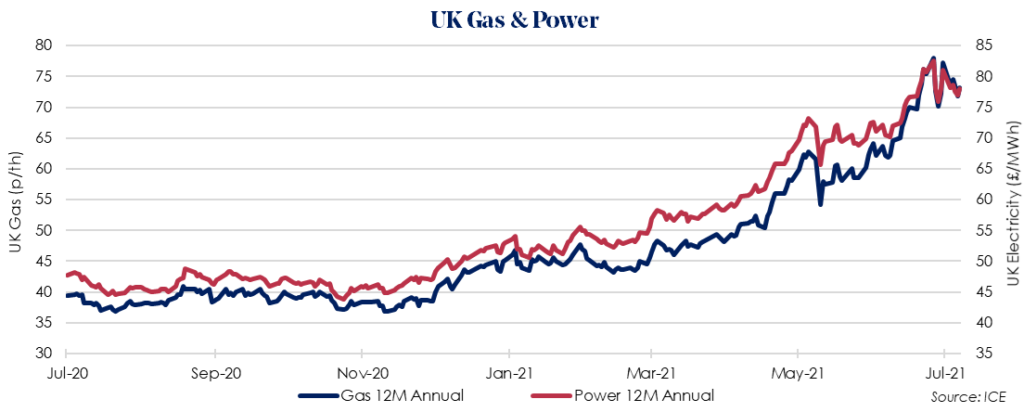

The Oct 2021 12 Month Gas price declined 5.2% to 73.20p/therm on rising UK North Sea supply. However, as European gas storages are still only 52% full this continues to be the largest supply risk ahead of the colder winter period.

The Oct 2021 12 Month Power price saw drop of 3.7% to £78.07/MWh, tracking gas and carbon prices lower.

Despite last week’s losses, prices for both gas and power are still being supported by high levels of tender activity in the run up to the 1 Oct renewal date.

The months of July, Aug and Sept are the busiest in the industry, meaning any clients who haven’t yet secured their new contracts will all be asking suppliers for prices at the same time, driving prices even higher.

Though energy prices are already close to record highs, it is widely expected that prices will remain high for the next two months, meaning any clients with open volume in 2021 should be locking out their contracts as a matter of priority.