The May 2021 Gas price rebounded 9.2% to 51.15p/therm last week, as a combination of maintenance at gas facilities in the North Sea and forecasted colder weather resulted in a short system, pushing prices up. This bullish sentiment continued across the week, with strong gains seen across the wider energy complex. Further gains in prices were limited by strong LNG send-out.

The May 2021 Power price climbed 7.1% to £60.67/MWh, in response to cooler forecasts and tracking movements in equivalent gas prices. Wind output, and renewable output generally, remained low across the week.

Gas and power prices also found continued support in carbon prices, while strong oil and coal markets also bolstered prices.

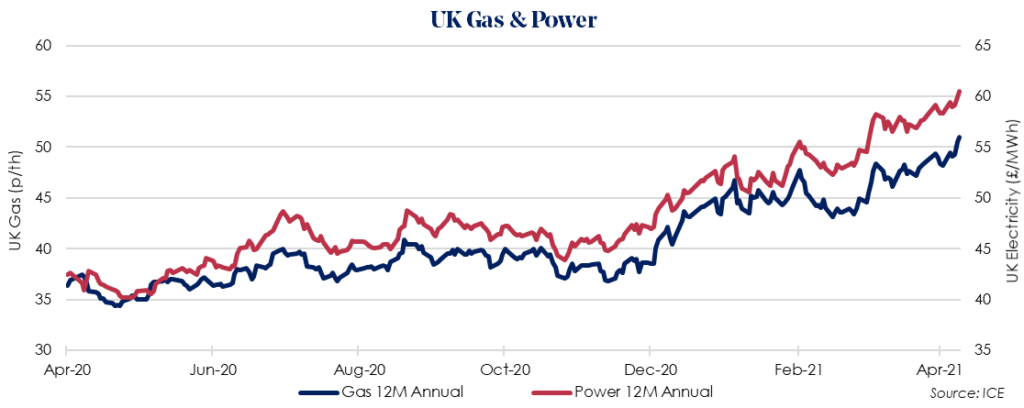

The Oct 2021 12 Month Gas price rose 5.7% to 50.96p/therm, as European gas storage continued to fall to around 29%. UK Gas storage also saw significant withdrawals, falling from 36% on 9th April, to 14% on Friday. Colder weather than normal is resulting in net gas withdrawals later than previous years. This time last year, European gas storage was around 58% full.

The Oct 2021 12 Month Power price rose 3.7% to £60.49/MWh, mirroring movements in the wider energy complex and supported by optimism of future demand recovery. The UK’s Covid vaccine rollout has now seen almost 33 million people receive their first dose.