The February 2021 Gas contract fell 2.2% last week, retreating from their highest levels in over two years trading last Tuesday. While ongoing LNG supply concerns continued, milder weather forecasts helped curb heating demand.

The February 2021 Power contract rose and fell back, ending the week largely unchanged, following concerns about short term power availability last week.

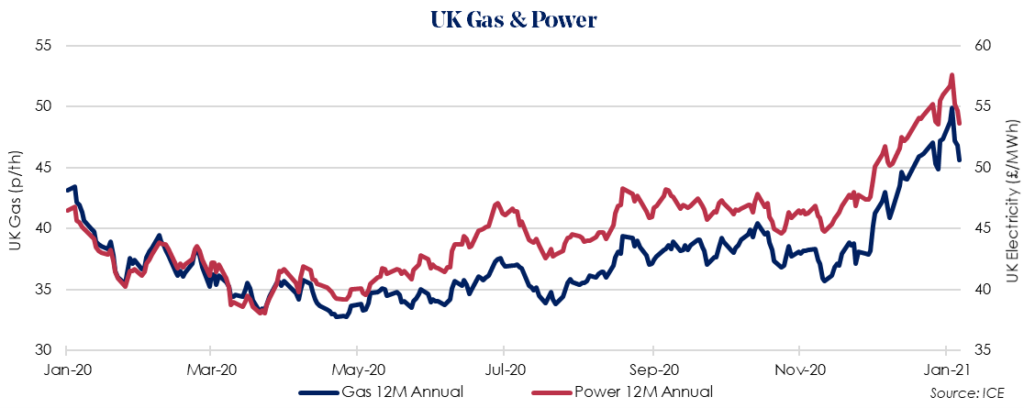

The April 2021 12 Month Gas price reversed previous gains and fell by 3.7% last week, despite European gas storage levels remaining relatively low compared to last year. Facilities are currently just over 64% full, while mid-January 2019 was around 81%.

LNG prices remained strong, fueled by cold weather, tight supply, and strong demand in Japan, who rely on LNG to meet heating, manufacturing and electricity generation demands. As a result, many cargoes have been diverted to Asia. However, moving forwards it is expected Asian LNG prices will recede with warmer weather, bringing more supply to Europe.

Meanwhile the Nord Stream 2 gas pipeline operator plans to lay the final 150km of pipes in 2021, after Germany and Denmark granted permission to restart construction immediately.

The April 2021 12 Month Power price fell 4.2% last week, tracking losses in gas and carbon prices. Power prices across the wider European market generally eased last week, reflecting forecasts for a ramp up in French nuclear production and German wind output.