The June 2021 Gas price surged 12.2% to 68.71p/therm last week as forecasts for cooler than normal temperatures combined with low European gas storage lifted energy prices.

The European storage surplus triggered by Covid-19 peaked near 30 bcm vs the five-year average last spring but now stands at a 13 bcm deficit, sitting at just 33% of maximum capacity. In the UK, gas storage is just 9% full.

The June 2021 Power price tracked the gas market closely, gaining 11.8% to £77.85/MWh. Prices remain high as carbon breached €56/tCO2 for the first time in its history. Carbon remains the main price driver, with a share of fundamentals supporting the previously speculative rises in the market. With low gas storage across Continental Europe, the need to burn coal for power generation continues to increase. This has subsequently provided support to the carbon market as demand for credits has increased.

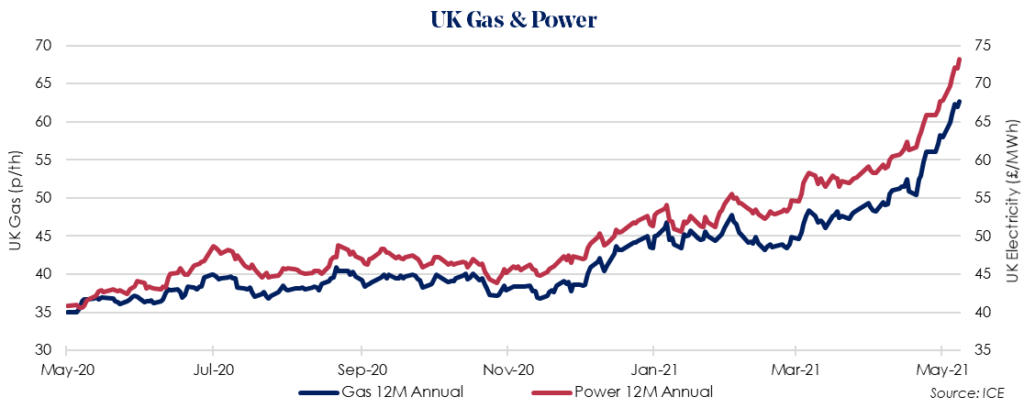

The Oct 2021 12 Month Gas price increased significantly last week, rising by 8.1% to 62.70p/therm. This is driven principally by the very high costs of Winter 2021/22 as low European storage will likely take time to recover, heightening the risk of Winter shortages.

The Oct 2021 12 Month Power price rose by 7.9% to £73.20/MWh. Increases in the price of power are expected, with easing Covid-19 lockdown measures spurring demand. The current magnitude of the price increases remains driven by the record-breaking cost of EU carbon.