The UK’s Day-Ahead gas price fell 5.2% to 21.45 p/therm, as very high LNG imports consolidate a gas supply already 61% more supplied than the 5-year mean. This supply is complemented by the warmest start to the year on record.

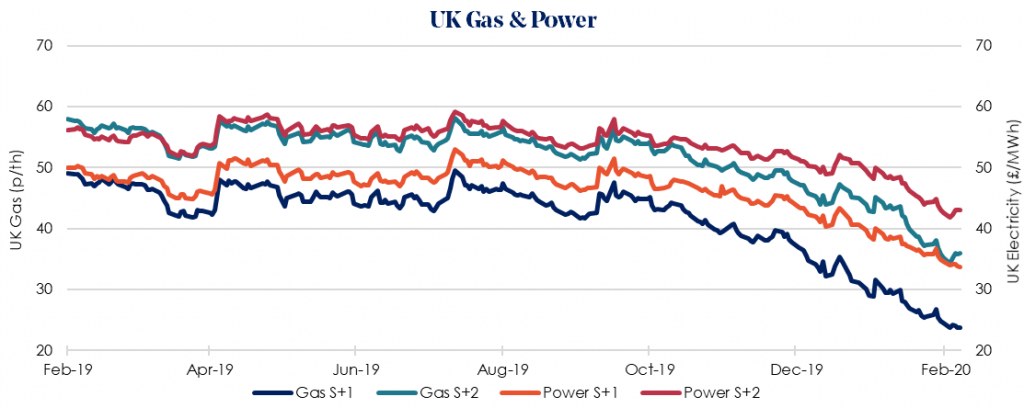

The Summer 2020 gas price declined 1.8% week-on-week to 23.31 p/therm, with the equivalent power contract dropping marginally by 0.2% to £33.69/MWh, less affected by the warm start to the year.

As has been the story for some weeks, European high levels of gas storage, record deliveries of LNG and what’s being described as “the largest weather-driven cut in fuel consumption in the Northern Hemisphere’s history” all bolster confidence in next summer’s supply and demand balance.

On a shorter scope, bullish risk caused by Storm Dennis has reduced LNG send-out from all three UK terminals, however this is somewhat mitigated by greater than normal Norwegian Imports.

Fourteen LNG tankers are scheduled to arrive in Britain over the coming week set to bring a total of 3.1million m3 of LNG into the UK.

Last week’s low crude oil prices have now seen an upswing after demand dropped to new lows, with China now importing to South Korean storage as mainland storage nears capacity. This has led to OPEC+ agreeing to drop supply by 1.7million bpd.

Seasonal contracts are mixed, with S-20 and W-20 being very low but then S-21 and W-21 are increasing. Therefore, our recommendation is to lock in contracts before June 2020.