The UK’s Day-Ahead gas price rose by 2.1% to 24.00 p/therm. This has been due to milder weather last week giving way to cooler temperatures for this time of year, resulting in strong demand for gas for power generation, leaving the market undersupplied.

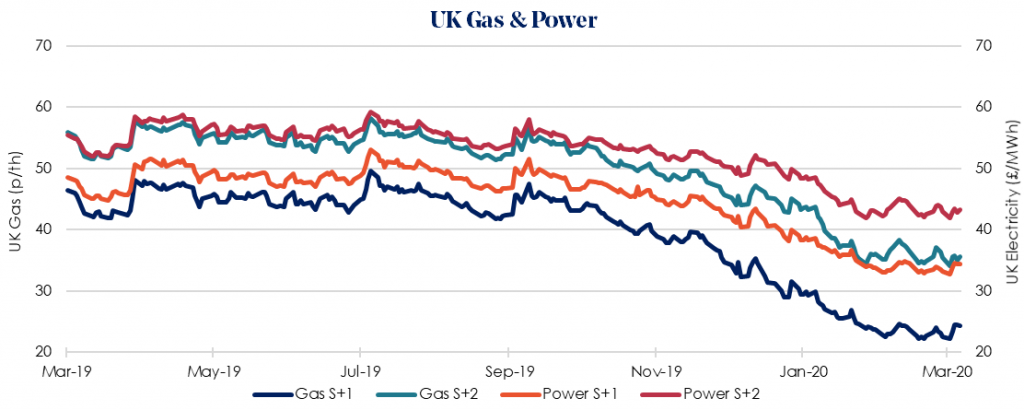

The Summer 2020 gas price rose by 7.9% week-on-week to 24.34 p/therm, with the equivalent Summer 2020 power seasonal price rising 3.4% to £34.34/MWh. Commodity markets have displayed a small rebound toward the end of the week despite sharply weakening equity markets as coronavirus disruption continues.

Bullish drivers this week are mainly due to a tighter gas supply and although still strong, wind output was weaker than traders expected. Analysts forecast demand for gas from power stations at 62 mcm on Friday, up 24 mcm on the previous forecast.

Bearish drivers mirror slumps in oil and equity markets. Further reduction in demand following the coronavirus outbreak across Europe could put more pressure on prices to drop to levels that encourage producers to curb supply earlier this summer than previously expected.

Despite the rebound seen at the end of last week seasonal contracts overall remain low. Sum-21 and Win-21 are relatively steady with marginal decreases across gas and power. Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to coronavirus driven economic slowdown.