The April 2021 Gas rose 15.2% last week as colder weather forecasts across the UK and Continental Europe led to European gas storage falling below the 5-year average for this time of year. Unplanned Norwegian outages last week also helped to boost short term prices. Scheduled deliveries of LNG were delayed due to strong winds in the seas around the UK preventing shipments from docking.

The April 2021 Power rose 9.8% last week tracking the equivalent gas contract. Gains were limited slightly by high wind generation last week, but wind speeds were forecasted to drop off over the weekend and into this week providing support for April Prices.

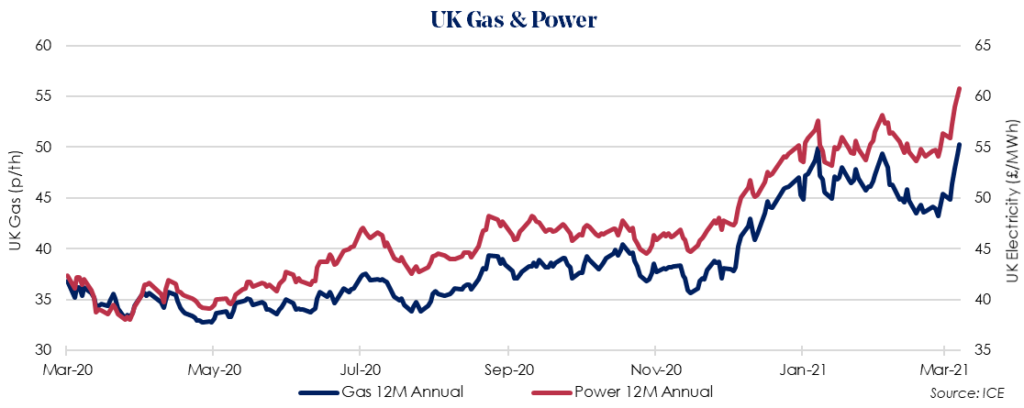

The April 2021 12 Month Gas price rose by 10.6% last week with strong gains for both Summer 21 and Winter 21/22 prices driven by the supply concerns and outages. European gas storage is currently at its lowest point in 3 years at 32.5%.

Optimism for economic recovery continues to increase energy demand estimates for later this year. Coronavirus vaccine rollouts are continuing, and oil imports are increasing worldwide.

The April 2021 12 Month Power price rose by 8.0% last week following the gains in gas. Additionally, power prices were bullish following a new record set by European Carbon as uncertainty over new EU climate laws boosted carbon credit prices.