The March 2021 Gas contract fell a further 6.9% last week. This followed a general increase in European temperatures as well as an improved expectation for LNG shipments to Europe.

The March 2021 Power contract fell 3.6%, due to warming temperatures and falls in the price of gas.

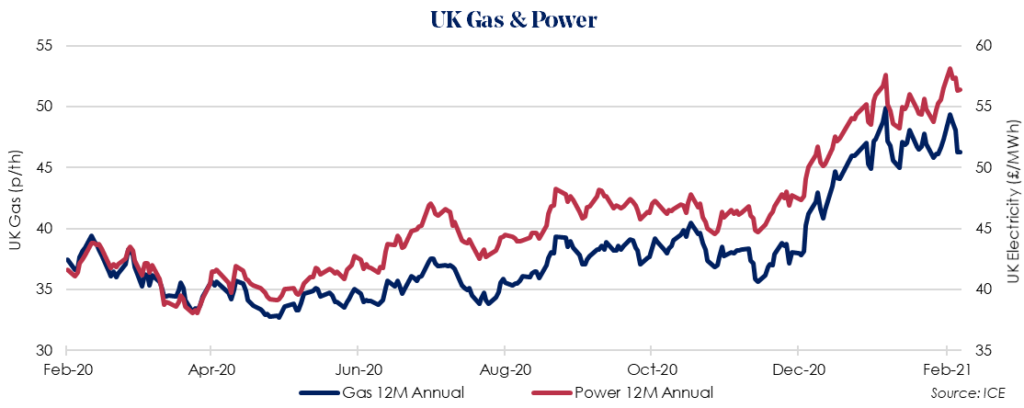

The April 2021 12 Month Gas price saw a fall of 2.2% last week. Despite European gas storage continuing to fall to 46%, down 30% on last year and 4% on 2019, there’s optimism for further LNG deliveries.

With 12 shipments of LNG expected into the UK over the next 7 days, short-term drivers of gas prices have eased and subsequently brought down the 12-month prices.

The falling price of coal this week is also likely to have an impact on European demand for gas-fired generation. As coal prices fall the demand for gas, as a substitute, reduces.

The main driver of 12M annual markets is the reduction of near-term prices as temperatures increase as we move out of winter. The impact of improved LNG supply, with a growing volume now being purchased from Russia, is however the most significant driver and is likely to see an increase in storage levels soon.

The April 2021 12 Month Power saw little movement last week with a small 0.2% price fall. The price remains balanced this week despite warming temperatures and a strengthening Pound. The continued rise of carbon prices is acting as a balance in driving electricity prices up into the longer term.