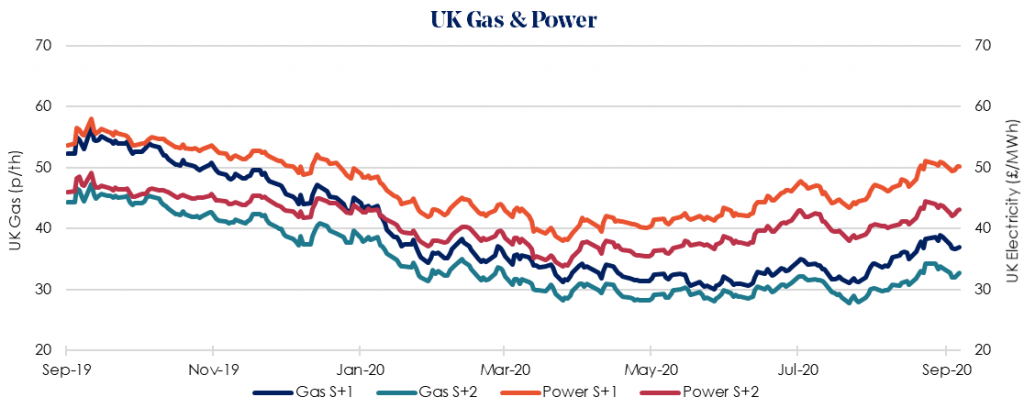

The UK’s Day-Ahead gas fell by -10.0% to 27.35/therm as temperatures this week were reforecast to rise sharply after a brief cooler spell last week. The warmer temperatures will reduce demand for heating.

Day-Ahead power saw little change, gaining 0.2% to £37.67/MWh as wind and solar availability was expected to fall below the seasonal norms over the weekend and into the start of this week.

Winter 2020/21 power prices saw a slight fall of -1.3% to £50.11/MWh tracking the equivalent gas season lower.

While power generation for winter is generally expected to be comfortable, EDF has extended all seven of its 10-year inspection outages planned at French reactors this year, totalling 400 days to date. The UK continues to import significant volumes of power during peak winter periods and in recent years, French nuclear outages have frequently had a notable impact on prices.

Winter 2020/21 gas slid 4.3% to 36.99p/therm. Gas pipeline imports into Britain were suppressed following maintenance outages at Norway’s major Nyhamna and Troll gas fields.

Meanwhile UK production is also lower impacted by restrictions at several gas terminals. However, UK Continental Shelf gas production is expected to increase to 108 mcm/d this week compared to 95 mcm/d last week. Additionally, South Hook LNG send-out remains steady, while the Isle of Grain and Dragon terminals are likely to remain muted until temperatures drop.

With temperatures picking up his week it is an ideal time to think about winter purchases. However, this will likely be short-lived, so our recommendation for clients with open Winter volume remains to lock this in as soon as possible.