The July 2021 Gas price rose 7.8% to 67.60p/therm last week on Norwegian gas maintenance and rising LNG prices.

LNG prices rose for the second consecutive week, buoyed by higher oil prices and stronger demand from China and Europe. LNG prices are expected to rise over the course of 2021 as vaccination rates improve and strict restrictions are gradually repealed.

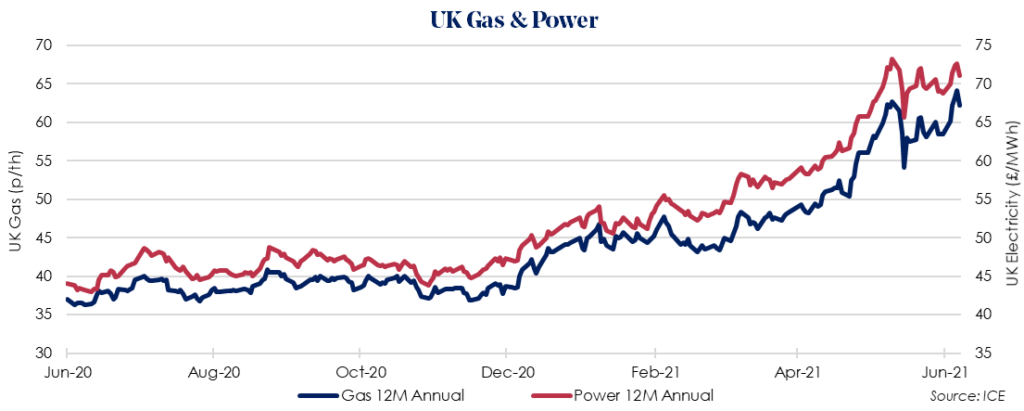

The Oct 2021 12 Month Gas price rose 6.3% to 62.33p/therm as Europe faces an uphill battle to refill gas storages before next winter.

Injections into European storages were 33% below the 5 year normal in May, exacerbating an already tight storage picture. There has been a distinct lack of pipeline supply response to high hub prices, while robust Asian LNG demand (driven by a strong economic recovery in China) has seen reduced LNG imports into Europe compared to 2019-20.

Meanwhile, the operator of Nord Stream 2, Russia’s controversial gas export project, has started pre-commissioning activities to start filling the first leg of the Baltic Sea line with gas.

The Oct 2021 12 Month Power price saw an increase of 3.3% to £71.05/MWh, following gas and carbon prices higher.

Carbon remains a key price driver for UK and European power and any significant movement is likely to be critical for the direction of UK energy prices in both the short and long term.