The January 2021 Gas contract rose 8.9% last week, following concerns of a looming strike at EDF’s French Power plants that is likely to increase gas-for-power demand to fill the gap, contributing to a tighter supply outlook. In addition, several scheduled maintenance outages across Norwegian gas facilities could see pipeline imports drop by as much as 31 mcm/d over the holiday season.

The January 2021 Power contract increased 3.5% tracking increases in UK gas, as well as European carbon and coal. While French nuclear outages are not expected to have any major effect on power output, the UK has been impacted by severe nuclear disruptions in recent years. Therefore, it makes sense not to dismiss the strikes as irrelevant.

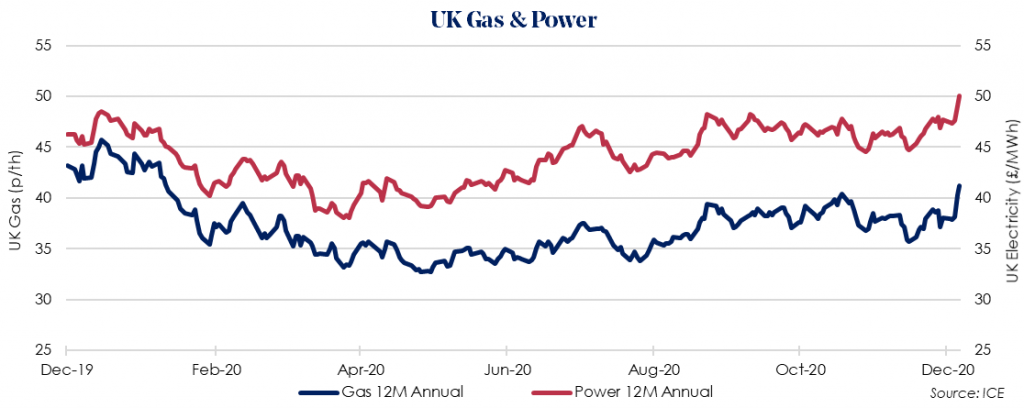

The forward April 2021 12 Month Gas price rose by 8.3% last week. Price rises were driven by a ramp up in withdrawals from UK gas storage combined with the continued increase in European coal prices.

The April 2021 12 Month Power price rose 4.8% last week, tracking significant gains in gas.

The significant price gains in both UK Gas and Power follow news that the UK has already started to rollout Covid-19 vaccines with the United States to follow suit shortly potentially represent a major boost for economic and energy demand forecasts for next year.

It is likely that average prices will continue to rise as we move further into winter. As a result, the recommendation remains to lock-in this week or, if possible, wait until Summer 21.

Brent crude oil climbed 1.5% to $49.97/bbl last week, its highest point since March. Prices have risen on the back of increased optimism for demand recovery, as the UK commenced its Covid-19 vaccination programme, with the United States set to follow this week. Elsewhere, Boris Johnson has announced that the UK government will cease to support the fossil fuel energy sector overseas, including export finance and trade promotion. The policy change is expected to come in prior to COP26 hosted in Glasgow, November 2021.

European coal prices rose 4.0% to $64.35/tonne last week as we move further into what is now being described as a “severe northern hemisphere winter”. Chinese production is also being curtailed due to pressure to step up safety inspections. The extent of this curtailment is being felt globally as China looks to recover its losses through imports.