The UK’s Day-Ahead gas price fell by 7.5% to 14.80 p/therm as the UK wholesale market continues to feel the effects of the COVID-19 pandemic. Lockdowns have been seen around the world in an attempt to limit the spread of the disease, which has caused huge losses in demand of up to a quarter of global consumption.

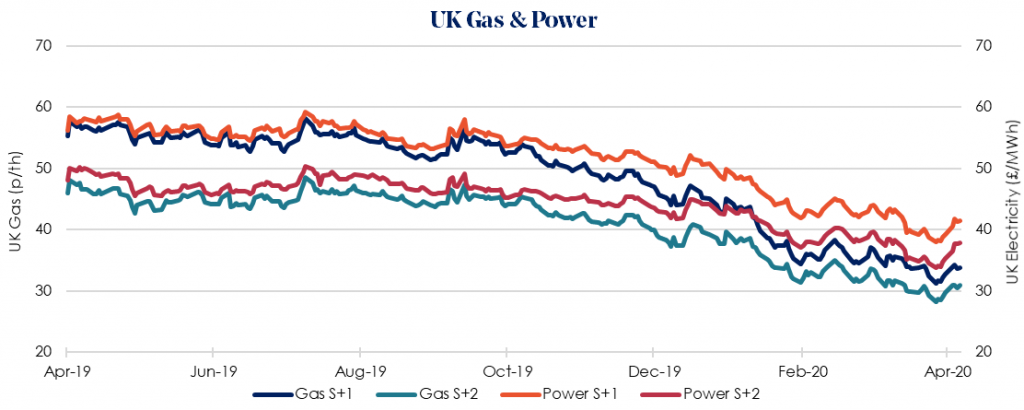

The Winter 2020/21 gas price rose by 3.5% week-on-week to 33.86 p/therm, with the equivalent Winter 2020/21 power price also rising, by 5.8% to £41.51/MWh. Increases in the gas market were fuelled by hopes of a cut in oil output, although an already oversupplied system capped upward movement.

Pipeline gas flows from Norway to the UK remained low as the summer gas season started. Pipeline gas flows to Britain were only around 45 mcm/d on Friday, down from 50 mcm/d week-on-week.

Besides the decline in oil prices and reduced demand the gas market is already under pressure from record-high stocks, which are currently 25% fuller than the average level at this time of year compared to the past five years. This is the result of last year’s record-high shipments, combined with a mild winter.

Seasonal contracts remain low and continue to fall. Sum-21 and Win-21 once again posted decreases across gas and power. Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.