The UK’s Day-Ahead gas price fell 3.7% to 13.00p/therm last week as the UK gas system was oversupplied, caused by lower gas for power demand. This was compounded by unseasonably strong wind generation earlier in the week.

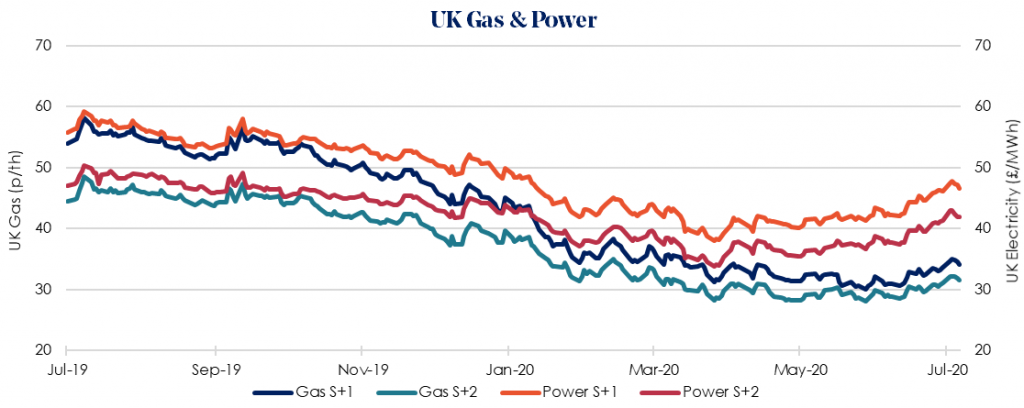

Winter 2020/21 gas rose 1.1% week-on-week to 34.03 p/therm, with the equivalent Winter 2020/21 power price rising 1.2% to £46.63/MWh. The key driver in recent weeks has been that energy demand across both the UK and Europe is on the rise as more and more businesses return to normal with lockdown restrictions easing.

Week-on-week gains persisted across the forward energy market, despite the U.S. experiencing a record increase of nearly 67,000 new Covid-19 cases on Friday, raising concern that global fuel demand growth could stall again if we experience a second wave.

Brent Crude oil rose 1.0% last week to $43.24/bbl. Fears remain that a spike in Covid-19 cases in the U.S. could curb fuel demand and pressure prices downwards. However, positive economic data supported prices, as global economies reopen.

Our recommendation remains to lock in contracts as soon as possible as prices gradually rise following the easing of lockdown restrictions.