The UK’s Day-Ahead gas price continued to rise last week, climbing 8.7% to 14.35 p/therm as demand begins to return, with signs of a progressive restarts in European economies emerging.

The equivalent power prices saw an increase of 11.3%, supported by cooler weather earlier in the week, along with weaker renewable generation.

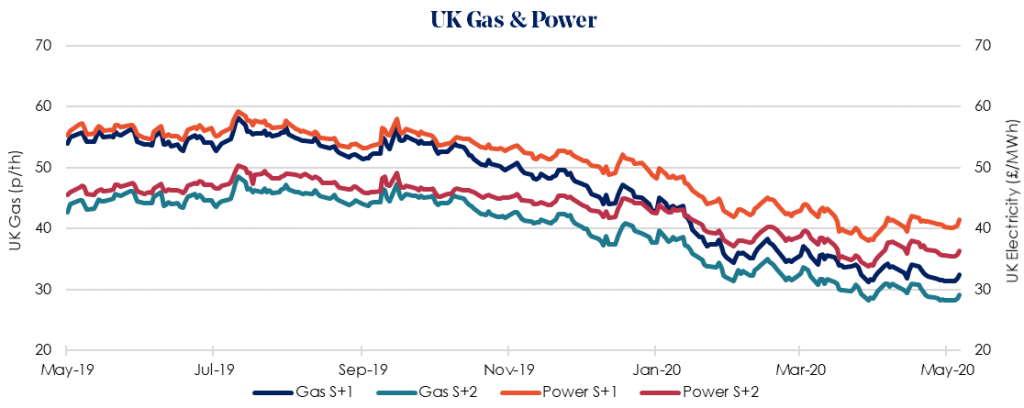

The Winter 2020/21 gas rose 3.6% week-on-week to 32.46 p/therm, with the equivalent power price rising 2.8% to £41.41/MWh.

Pipeline gas flows from Norway to the UK continue to stay low but stable, sitting around 31 mcm/d last week.

Scheduled maintenance is due to start on Tuesday at the Norwegian Kollsness processing plant, with impact of 107mcm/d, with additional planned maintenance at Troll gas field beginning midweek. However, given the current low Norwegian flows to the UK it is believed both outages will have little to no impact on flows.

Low prices continue to persist, with the front of the curve dictated by healthy supply and storage levels, paired with reduced gas demand and low oil prices.

LNG send-out peaked at 65 mcm/d on Tuesday but levelled off at around 53 mcm/d later in the week. Thursday saw four cargoes arriving at the South Hook terminal.

Our recommendation is to lock in contracts before June 2020 ahead of expected volatility related to Covid-19 driven economic slowdown.