The February 2021 Gas contract climbed 7.6% last week, as several key European gas markets reached two-year highs. This came following concerns of reduced LNG supply to Europe as well as generally colder than average temperatures on the continent, with the UK 1.6°C lower than normal.

The February 2021 Power contract rose 7.3%, mirroring increases in UK gas, as well as European carbon and coal.

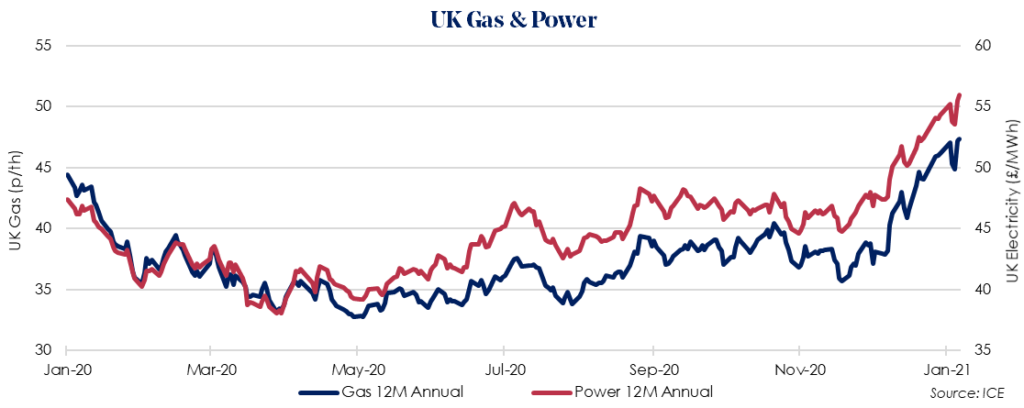

The April 2021 12 Month Gas price rose by 2.6% last week. Gas inventories in Europe are currently around 70% of full capacity, almost 20% lower than this time last year.

Japanese LNG prices have reached their highest level on record (even high than following the Fukushima nuclear disaster in 2011), with cold weather in Asia paired with reduced tanker availability thought to be the cause. While markets are generally higher in winter compared to summer months, prices have recently reached four times those seen in September 2020.

As demand looks to grow following Covid-19 recovery, prices are anticipated to keep rising.

The April 2021 12 Month Power price rose 3.0% last week, tracking significant gains in gas.

The significant price gains in both UK Gas and Power follow news that the UK has started the roll out of Covid vaccinations, with over 2 mln vaccines given out already. This represents a major boost for economic and energy demand forecasts for next year.