The UK’s Day-Ahead gas price fell 9.8% to 22.63 p/therm, as higher LNG imports and plentiful gas supply in Northwest Europe complimented Britain’s above seasonal normal temperatures last week.

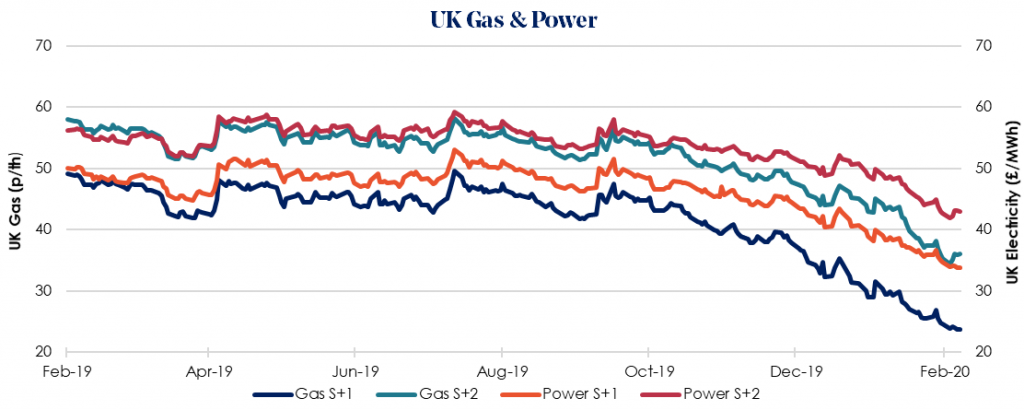

The Summer 2020 gas price declined 3.5% week-on-week to 23.73 p/therm, with the equivalent power contract also losing 2.6% to £33.76/MWh.

The UK and Europe’s high levels of gas storage, combined with record deliveries of LNG and unseasonably strong power production in Europe’s Nordic and Central European regions, mean the outlook for next summer’s supply and demand balance continues to look comfortable.

Benchmark Asian LNG prices hit record lows last week while China’s top LNG buyer China National Offshore Oil Corporation (CNOOC) declaring force majeure on some prompt LNG deliveries with several suppliers. The drop in Asian LNG demand means global LNG supply could be diverted into the already saturated European gas market.

Six more LNG tankers were added to Northwest European terminal arrival schedules on Monday, with 23 tankers set to arrive this month.

Lower crude oil and carbon prices also contributed to price declines for the upcoming season, although winter prices edged higher in response to uncertainty over power capacity concerns in Central Europe.

Prices for seasonal contracts are now fairly mixed, and the uncertain nature of energy markets means we recommend going to market now and getting contracts locked in before the end of June.