The UK’s Day-Ahead gas price rose by 45.5% to 19.50p/therm with a marked increase in gas for power generation as wind output remained weak.

Day-Ahead power rose by 7.2% to £33.25/MWh, as temperatures soared over the weekend and demand increased for cooling across Europe.

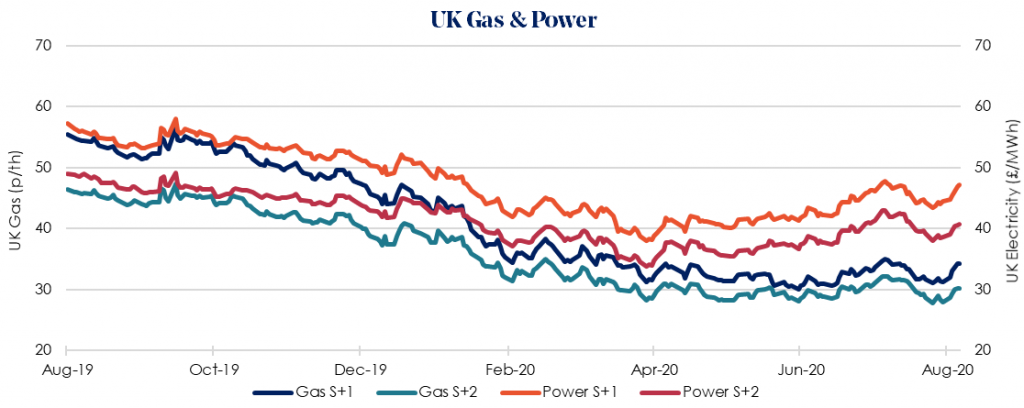

Winter 2020/21 gas rose 9.8% last week to 34.27 p/therm, with the equivalent power price seeing a rise of 6.0% to £47.09/MWh. With planned maintenance scheduled across Norwegian pipelines over the next few weeks and gas storage now drifting closer to the 5-year range may see gas prices fall back within an expected range moving into Winter 2020/21.

The losses seen in the energy market last week seem to have largely bounced back. Stronger fundamentals, largely driven by forecast gas maintenance and increased electricity demand to combat the hot weather, outweighed wider market fears of a second wave of Covid-19.

Newfound optimism about the flattening of the rate of Covid-19 infections may also begin boosting prices, should it continue.

Gas storage does remain well above the 5-year maximum for this time of year, but as we approach Oct/Nov storage levels are trending back towards a normal range. Two Qatari shipments of LNG are leading to the UK system being 11mcm oversupplied this week.

Our recommendation remains to lock in contracts as soon as possible as prices are at risk of further volatility following the easing of lockdown restrictions.