The UK’s Day-Ahead gas price continued to fall last week, by 2.7% to 9.05p/therm.

Day-Ahead power recovered to £21.48/MWh following the previous week’s record drop into negative figures.

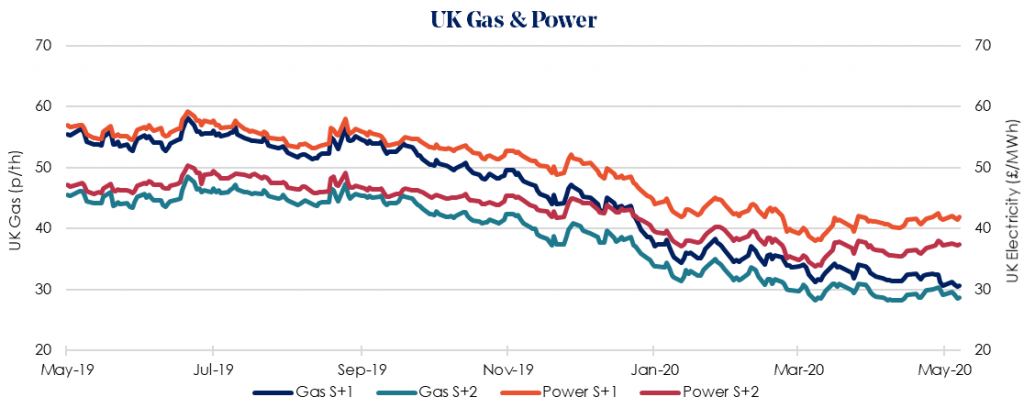

Winter 2020/21 gas was little changed last week, down at 30.65 p/therm. However, the equivalent power price recorded a small rise of 1.4% to £41.94/MWh.

The UK gas price remains low with sentiment driving prices lower as temperatures remain above the seasonal normal, limiting demand. The UK system is now close to the summer minimum gas demand. Annual scheduled maintenance works at Kollsnes is not expected to impact price this week as flows already sit below capacity.

The major potential impact to price this week will be the recovery of Russian flows into Europe following a two-week closure. Should this increase substantially it will reduce UK exports to the continent and continue to oversaturate the UK market, with gas storage 23% higher than last year, pushing prices down further.

With a recent drops in wind output, matched by falling gas prices, the boost in profitability of burning gas-for-power generation is likely to increase, if weather and gas price forecasts persist.

Our recommendation remains to lock in contracts as soon as possible as economic uncertainty persists with new concerns of a potential second wave of Covid-19.