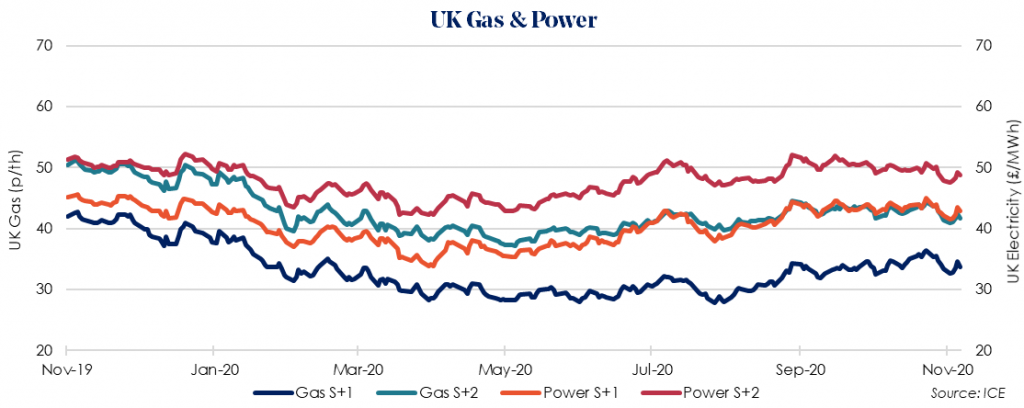

The UK’s Day-Ahead gas rose by 4.6% to 36.30 p/therm. As the weather continues to cool, prices are likely to see an upward trajectory into winter.

Day-Ahead power rose by 16.9% to £43.84/MWh, reflecting a drop in power output from wind generation.

December 2020 power has seen a small price fall as the Lynemouth EPH biomass-fired plant expected to restart generation following an unplanned outage as early as this Friday, reintroducing 400MW onto the grid.

December 2020 gas also saw a small price drop with LNG supply to Europe ending the week 15% higher than earlier forecasts. Additionally, Norwegian flows remained strong despite UK demand rising to 3.4% above the 5-year average.

Summer 2021 gas increased by 1.3% this week, to 33.77 p/therm, as the initial shock of a second England-wide lockdown waned, and cooling winter temperatures began to take precedent again.

Summer 2021 power also saw a rise of 2.0% to £42.96/MWh, as carbon prices recorded a significant rise due to weaker wind output.

Gas and Electricity contracts have risen since the lockdown driven falls last week. It is likely that average prices will continue to rise as we move further into Winter, therefore the recommendation remains to lock-in now or, if possible, wait until Summer 21.