The April 2021 Gas rose 3.7% last week due to a colder weather forecast and weak wind generation leading to additional gas storage withdrawals despite close to capacity flows from Norway’s Langeled pipeline.

The April 2021 Power contract also rose by 2.5% last week as drops in both wind output and solar generation were impacted for the first half of the week in conjunction with colder temperatures that resulted in a strong reliance on gas-fired power and increased reliance on coal.

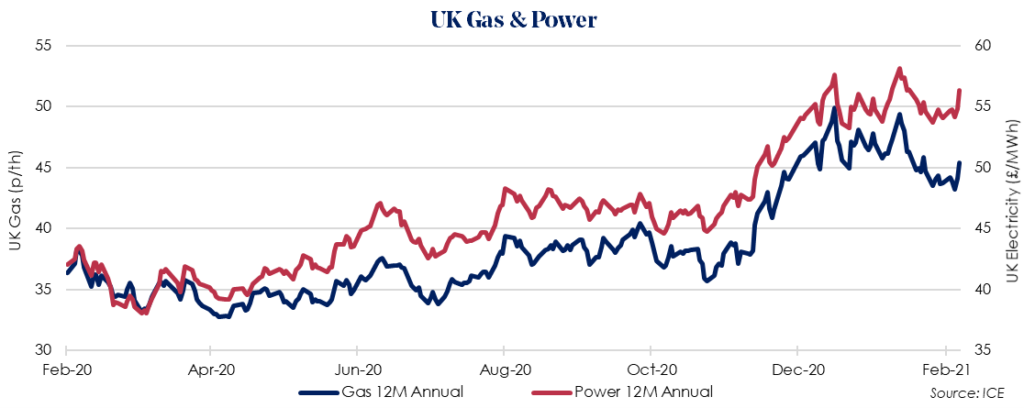

The April 2021 12 Month Gas price rose by 3.9% despite a strong schedule for LNG cargoes. The UK received 3 LNG shipments this week with a further 10 scheduled to arrive by mid-March. However, prices found support from an increase in carbon and demand forecasts.

The UK vaccine rollout passed the milestone of 20 million first doses this week providing optimism of an economic recovery later in the year.

The UK’s busy schedule for LNG arrivals throughout March continues to provide some bearish pressure looking ahead. Meanwhile, European gas storage continued to decline to 35% with slightly higher withdrawals this week due to colder weather across the continent.

The April 2021 12 Month Power price rose by 4.1% tracking the equivalent gas contract, short gas system and rise in carbon price.