The UK’s Day-Ahead gas rose by 13.0% to 30.40/therm as gas to be used in power generation was expected to ramp up over the weekend due to an expected drop in both wind and solar output.

Day-Ahead power saw a rise of 4.7% to £37.58/MWh as wind and solar availability was expected to fall below the seasonal norms over the weekend and into the start of this week.

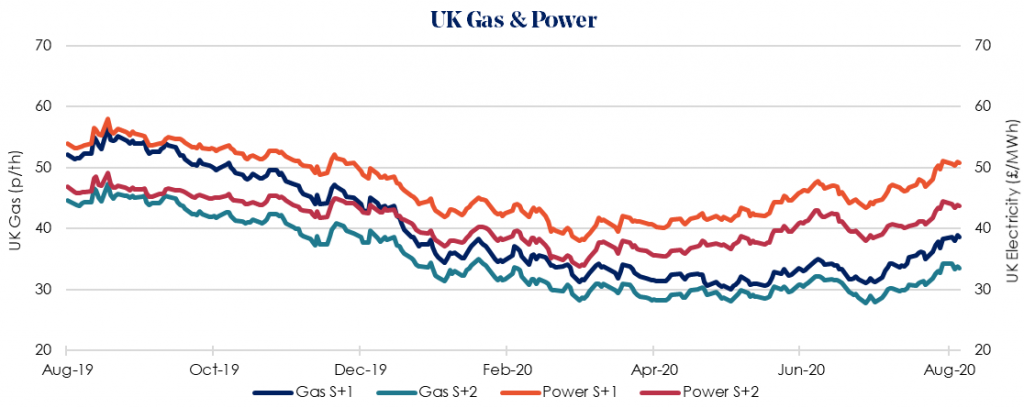

Winter 2020/21 power prices saw a slight fall of -0.5% to £50.79/MWh. This follows a marked reduction in the carbon price this week after the previous week’s rise because of French nuclear outages and reduced Bank Holiday Carbon Credit auction volumes. A reduction in European Coal prices also had a bearish impact on the power price.

Winter 2020/21 gas rose 1.1% to 38.66p/therm. UK production was cut by Forties pipeline maintenance last week. The maintenance was scheduled to last two days, but the signs of slow production led to some uncertainty around the return of Forties to provide some bullish sentiment to prices this week. This was mostly offset by a surge in Norwegian supply.

UK production is expected to increase substantially this week following the resumption of production impacted by the Forties Pipeline System maintenance. UK Continental Shelf gas production is expected to average 95 mcm/d this week compared to 51 mcm/d last week. Additionally, maintenance at Bacton Perenco terminal which began at the end of August should end at the start of this week.

With temperatures trending lower as we head towards the start of winter, our recommendation for clients with open Winter volume remains to lock this in as soon as possible.