The UK’s Day-Ahead gas rose 3.1% to 42.60 p/therm. Prices were driven by cold temperatures and low renewable output creating increased demand for gas for power generation. Gains were limited as the system, although tightening, remains oversupplied and this week saw the end of strikes at Norwegian gas fields increasing Norwegian pipeline supply. The National Grid predicts the gas system is currently 2.6% oversupplied moving into this week.

Day-Ahead power rose by 21.3% to £59.34/MWh following cold weather with temperatures across the UK below seasonal norms, a tightening gas supply and low wind generation all acting as bullish drivers.

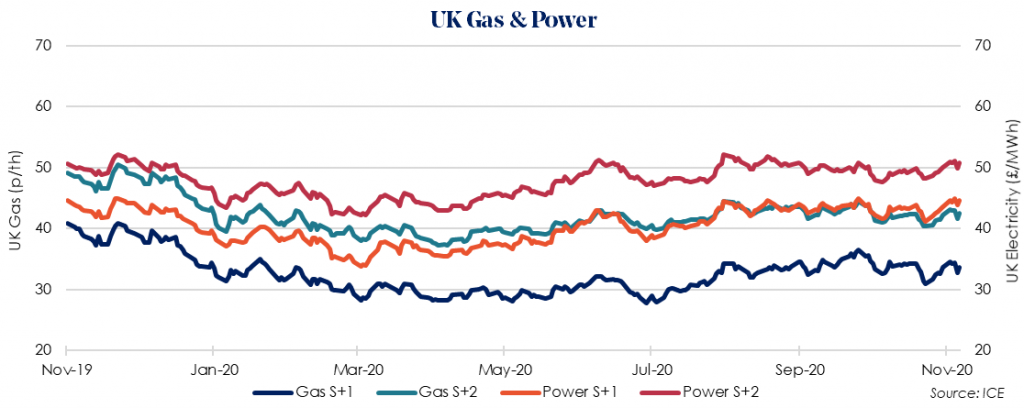

January 2021 gas rose 0.8% to 42.57 p/therm, prices increased slightly following an increased demand outlook although the oversupplied system limited gains. Meanwhile, Summer 2021 gas contracts were little changed.

January 2021 power increased 3.9% to £54.53/MWh supported by the UK’s tightening gas supply and predictions of the current cold weather continuing for a few weeks. Summer 2021 power also rose 2.5% supported by carbon EUAs rising above €30/tCO2 and increased coal prices.

It is likely that average prices will continue to rise as we move further into winter, therefore the recommendation remains to lock-in now or, if possible, wait until Summer 21.