The UK’s Day-Ahead gas rose 7.8% to 34.50p/therm as prices were pushed up by colder weather and lower Norwegian supply to Europe.

Day-Ahead power rebounded 18.7% to £40.81/MWh as the UK became widely covered by areas of low-pressure weather, hindering solar generation.

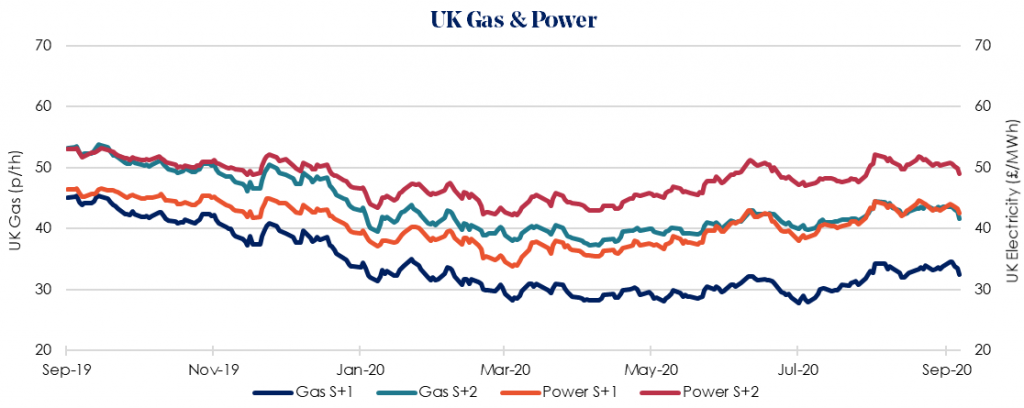

Winter 2021/22 gas fell by 4.3% this week, falling to 41.64p/therm. The main drivers of this are strong storage levels in Europe and Ukraine in particular, paired with uncertainty over COVID-19 and the potential restrictions on economic activity a second wave may bring.

Winter 2021/22 power prices fell by 2.8 % to £49.00/MWh mirroring the movement in gas, as an increase in the price of carbon along with uncertainty over the potential effects of Covid-19 this winter weighed on prices.

The UK gas system remains tight this week, opening undersupplied due to reduced Norwegian imports, adjusted lower by 11mcm/d. In addition to this, strikes planned by Norway’s Lederne union are due to start today after wage talks failed. It is expected some gas fields may have to increase output to compensate.

For businesses not renewing until early-2021, October may be the last opportunity to lock in contracts while energy prices remain low. If your contracts are not renewing until Oct-2021, there may be another opportunity for you during summer 2021. But it may be a good idea to lock in any earlier renewals as soon as possible before winter temperatures arrive.