The Aug 2021 Gas price rose 11.6% to 88.94p/therm last week, reflecting low supply from the UK’s LNG terminals, risks of unplanned pipeline maintenance outages and strong demand from the power sector led by an increase in carbon prices.

LNG send-out is still low at 7.5 mcm/d and no cargoes have been confirmed to arrive in Britain during July.

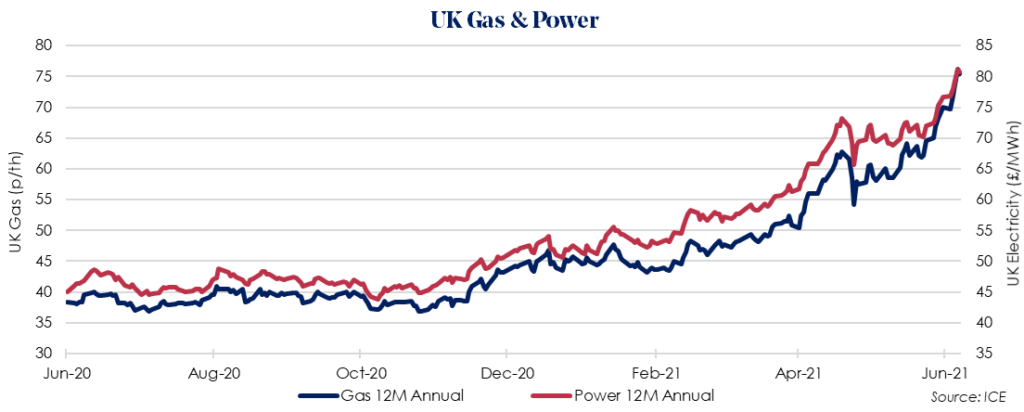

The Oct 2021 12 Month Gas price rose 7.8% to 75.40p/therm as European gas storages are still only 48% full. This continues to be the largest supply risk ahead of the colder winter period.

The Oct 2021 12 Month Power price saw an increase of 5.4% to £80.77/MWh, tracking gas prices higher as carbon and coal also provided bullish support.

In addition to the typical supply and demand fundamentals, prices for both gas and power are largely being driven higher by increased tender activity in the run up to the 1 Oct renewal date.

1 Oct is the most popular date for businesses to renew their energy supply contracts, meaning the months of July, Aug and Sept are the busiest in the industry. Any clients who haven’t yet secured their new contracts will all be asking suppliers for prices at the same time, driving prices even higher.

Though energy prices are already at record highs, it is widely expected that prices will continue to rise for the next three months, meaning any clients with open volume in 2021 should be locking out their contracts as a matter of priority.